Jump to winners | Jump to methodology

The wealth industry is at a crossroads.

For decades, it was tilted in the direction of firms and wealth professionals. With exclusive access to market intelligence and investment know-how, brokerages and financial firms were able to command high fees and secure a consistent base of business from consumers.

Now customer appetites have changed with the times.

Steve Willems, a wealth advisor at the Willems Wealth Planning Group with Assante Financial Management, says, “As advisors, our approach needs to address these emergent trends. … [C]lient preferences are changing quickly, so it’s important that the incoming generation of advisors contribute solutions that intersect with these trends.”

Wealth Professional’s Rising Stars 2022 have been recognised for their ability to adapt to the changing landscape and perform admirably. Being a Rising Star is an accolade many want but only a few successfully earn.

“We have a lot of great, young talented Canadians entering the wealth management industry here in Canada,” says Thane Stenner, senior portfolio manager and senior wealth advisor at Stenner Wealth Partners+, CG Wealth Management. “My sense is that a lot more people are trying to get in the wealth management industry. … For example, we posted eight roles in our firm and got 450 applications.”

“[C]lient preferences are changing quickly, so it’s important that the incoming generation of advisors contribute solutions that intersect with these trends”

Steve Willems, Willems Wealth Planning Group with Assante Financial Management

While the industry faces threats from multiple sides, it’s also able to strengthen itself in remarkable ways, thanks to the new talent that’s emerging.

Rising Star Willems has distinguished himself by having a direct hand in several digital initiatives. Drawing from his professional experience helping businesses with their digital marketing efforts, he helped launch a monthly call where clients can participate in a dynamic discussion of market events, launched a video series on behavioural finance topics, and also oversaw the delivery of over a dozen virtual donor events for five local charities, among other major value-adding projects.

“There are no shortcuts in life, and unfortunately no secret formulas,” Willems says. “But being a third-generation business owner has shown me that grit and determination are certainly necessary ingredients.”

Among several keystone principles and habits, Willems believes in quickly creating “a visible pile of activity” around new ideas, which can give rise to even better ideas and initiatives over time. “Don’t worry about the first idea not being perfect; just produce evidence of that concept,” he explains.

“You need to have a great attitude and master the basics. Have integrity, do what you say you’re going to do, return your calls, and basically be the advisor that you would like to have”

Mathieu Ouellette, The Oyler-MacDougall Group with BMO Nesbitt Burns

Believing that it takes a team to achieve great things, he also attributes much of his success to colleagues.

“Within your organization or region, find a small handful of other highly driven professionals. Come together on a predictable schedule, set an agenda, and you’ll find that being in their presence will provide the motivation needed to grow,” he says.

Another Rising Star is Mathieu Ouellette, investment advisor at The Oyler-MacDougall Group with BMO Nesbitt Burns. He is boosting his reputation as he navigates a central industry concern: as the retail crowd is becoming more cost-conscious, online brokerage platforms are challenging traditional advisors’ value proposition with low commissions, trading fees, and bargain management fees for the do-it-yourself investor.

“I think fee compression is an issue. That’s not to say that there aren’t any expensive products out there that might not be in the client’s best interest... But when it comes to having an advisor, it shouldn’t be a race to the bottom,” he says. “There are perhaps cheaper alternatives, but I tell my clients that those might not get them to where they want to be. And that they’re not going to find anybody more committed to their success than myself.”

Ouellette has built an impressive book of clients in just his first 21 months, surpassing the firm’s required targets. That achievement is made even more impressive by the fact that he made his initial outreaches in the midst of the global pandemic crisis when people were practicing social distancing and avoiding in-person meetings.

“You need to have a great attitude and to master the basics,” he says. “Have integrity, do what you say you’re going to do, return your calls, and basically be the advisor that you would like to have.”

Megan Martin, associate vice president, investments at Invico Capital Corporation, is another Rising Star turning heads at her company.

As a senior member of Invico’s investment management team, she developed the fund performance analysis methodology and procedures used in Invico’s reporting to dealer partners, investors, and regulatory bodies for several classes of shares with different return provisions. She is responsible for monitoring select loan portfolio accounts, and has been a critical driver of investment and credit documentation in compliance with underwriting policies related to return and, more recently, responsible investing and ESG. In recognition of those and other accomplishments, she has been promoted three times in three years.

“I remain open to learning new things,” Martin says. “I believe that stepping up to the plate and outside of my comfort zone has been, and will continue to be, my secret formula.”

Willems has a similar philosophy of learning through discomfort. “Clients will ask hard questions, you’ll have to give a frank assessment, you’ll need to deal with ethical quandaries. Expect this. And every time you go through one of those hard moments, write down what you learned and lock it in your lesson vault.”

That ethos of experimentation is something that Sol Amos, founder of AdvisorSavvy, sees more broadly among the emerging crop of new financial advisors by how more willing they are to leverage technology.

“They have a real appetite for different approaches to building portfolios for clients – not the very traditional 60/40 split portfolio, but they're looking at other options and whether that's getting them into private equity or private debt,” Amos says. “They are looking at a much broader product selection when they’re working with younger individuals.”

For Ouellette, it’s all about elevating his level of service.

“We don’t want to automate the client experience or take the personal out of the relationship, definitely not,” he adds. “But when it comes to administrative tasks, I think there’s opportunity to incorporate a little more technology so we’re spending more time actually dealing with clients.”

According to Amos, many young advisors today come into the industry because they feel the needs and perspectives of Gen Y or Gen Z clients are not being understood perfectly by older professionals.

“Their goal is really to relate and be a confidant or partner in that relationship with that younger segment that they feel is not being served right now,” Amos says. “Younger successful advisors are genuine in their conversations with their client. So they tend to be genuine in the way that they’re talking about their practice or their returns or just general planning, which is one conversational piece that might have been missing before from previous generations of advisors.”

“I believe that stepping up to the plate and outside of my comfort zone has been, and will continue to be, my secret formula”

Megan Martin, Invico Capital Corporation

The coming of a new breed of wealth management professionals could also help shine the spotlight on – and ultimately, solve – long-standing challenges of diversity and representation.

On gender equality, Martin says: “In many instances, women are relegated to ‘token’ positions, so I’m not convinced the solution is to implement gender diversity quotas … I believe that taking more of a top-down approach and focusing on education to help break long-standing stereotypes is likely the best path to gaining authentic diversity in the industry.”

From Martin’s perspective, the market extremes that the new wave of investment professionals have lived through since the onset of their careers have given them a greater ability to evaluate and monitor risk. But as a veteran, Stenner sees things very differently.

“Those under 35 have not really seen a deep recession or a really tough bear market. They’ve seen some volatility but for the last 12 years, it’s been a really strong bull market since the last great recession,” he says. “I think the expectations of the newer generation is that things usually have just gone up. Well, this year is demonstrating that there are bear markets. … [W]e’re starting to see some layoffs in the US, primarily in wealth management in the large brokerage firms. I think there will be some eyes opened in the next 18 to 24 months during what most likely will be a recession period.”

As grey as the near-term outlook appears, Stenner remains optimistic. He forecasts a bright future as long as the new crowd of financial professionals get their credentials, go the extra mile, hone their abilities in critical software tools, and sharpen their presentation skills.

“If you want to do exceptionally well in the wealth management industry, you have to hustle. You have to demonstrate enthusiasm and passion for this industry. You’ve got to show up, be present, and really exert time and effort,” he says. “Quite candidly, for those that do, I think there’s exceptional opportunity in the industry.”

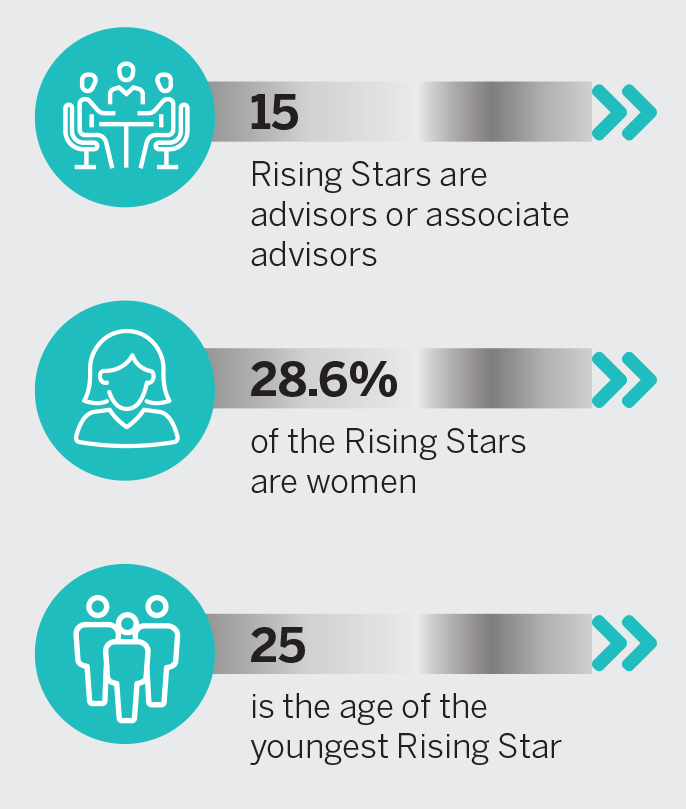

To uncover the most promising young professionals in the Canadian wealth management industry, Wealth Professional undertook a rigorous marketing and survey process, leveraging its connections to thousands of advisors across the country. Starting in June, companies were given the opportunity to nominate professionals for consideration based on their performance and achievements over the past 12 months.

To be eligible, nominees had to be age 35 or younger (as of September 30, 2022) and working in a role that relates to, interacts with, or impacts the wealth management industry. When reviewing the nominations, WP concentrated on those who have committed to a career in the industry and clearly hold a passion for wealth management. In order to maintain a focus on new talent, only nominees who hadn’t been previously recognized as a WP Rising Star (or Young Gun) were considered.

After reviewing all the nominations, the WP team whittled down the list to 41 deserving winners.