Jump to winners | Jump to methodology

The nation’s outstanding wholesalers are integral to the success of Canada’s advisors.

Wealth Professional undertook a rigorous marketing and survey process, leveraging connections to thousands of advisors, who rated their wholesalers on a range of criteria to select the Top 50 Wholesalers of 2025.

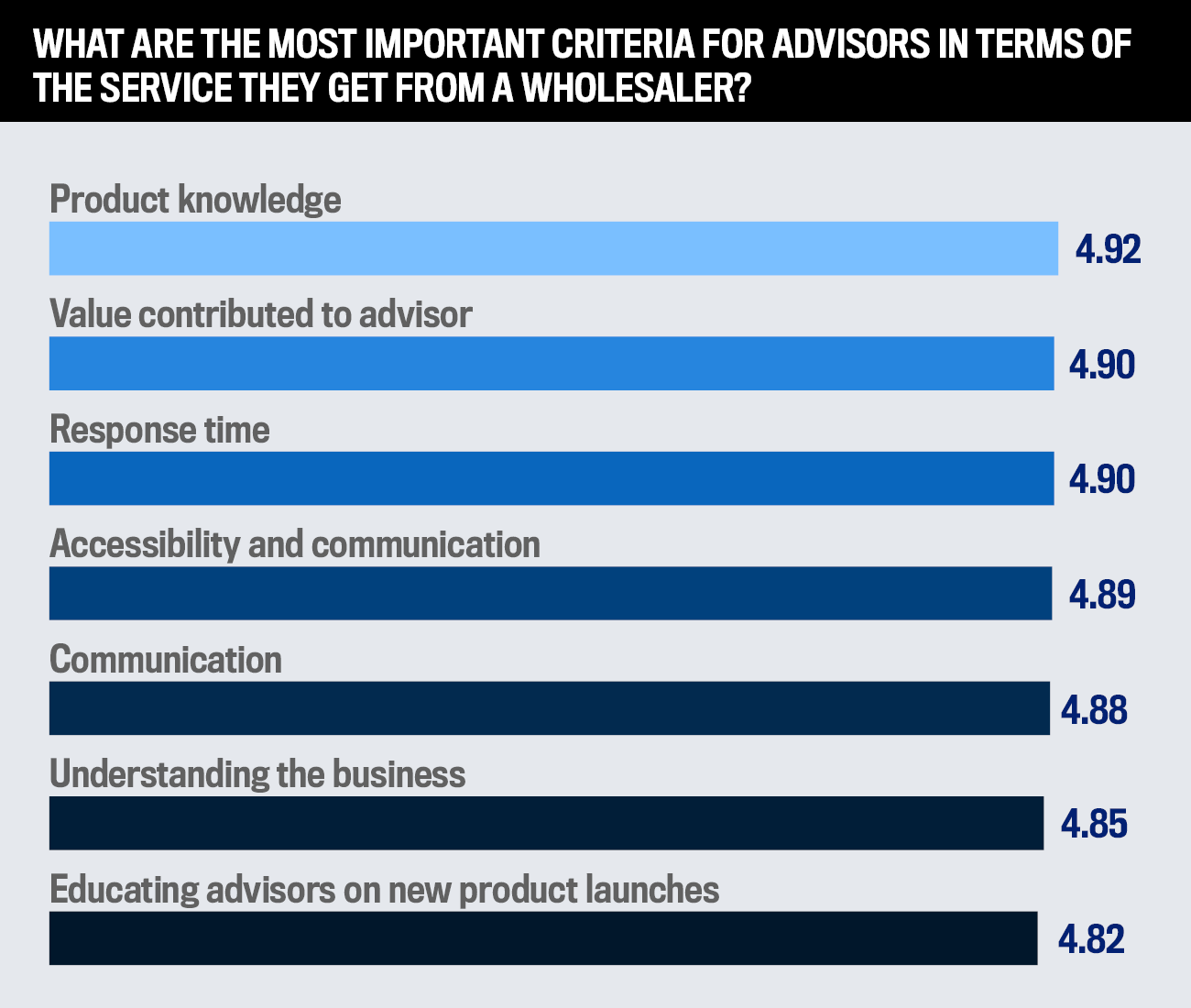

The advisors’ insights recorded the three most important attributes in a wholesaler as product knowledge, valued contributed to advisor, and response time.

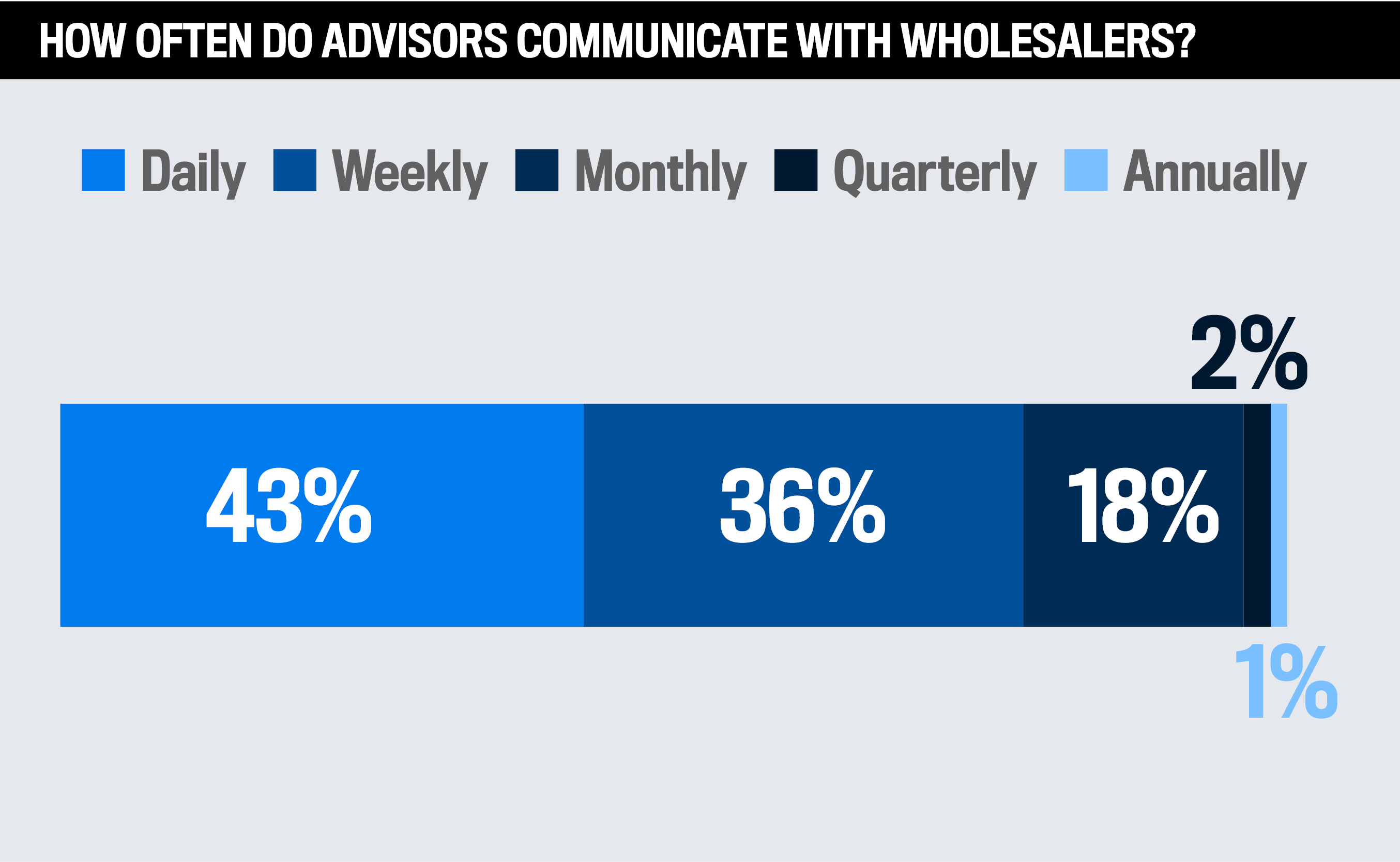

WP 's data also shows how accessible wholesalers are, with 79 percent of advisors reporting they are in contact with them either on a daily or a weekly basis.

Canada’s advisors also offered in-depth insights into what qualities they seek in a wholesaler. Some of the responses are featured below:

“Keeps advisors updated about product performance and changes.”

“The wholesaler should play the role of an investment consultant understanding the current investment environment and the products that fit the needs of clients. Less sales, more partner-type approach.”

“A professional who I can trust with his/her word, addresses issues on a timely basis, and knows his/her firm’s products.”

“They should care about the advisor as much as the advisor cares about their clients. When a wholesaler treats me as their important client, I feel that they bring me value and appreciate me regardless of the size of contracts.”

“Webinars are fine to a certain degree but should not replace in-person meetings and events.”

“Knowing their products and how they fit into the puzzle rather than trying to be the whole solution.”

“Someone who is personable, knowledgeable, and willing to spend time on more complex client cases.”

“A wholesaler who is not there to push products, but positions solutions that add value to my business. They should also understand my business and bring me current trends in the advisor world.”

Vice president, business development

Since November 2023, he’s been making his mark after relocating to Halifax and has since become responsible for a portion of Atlantic Canada. He emphasizes the importance of building relationships over product promotion and is an ardent believer in the value of listening to advisors to understand their needs.

“Something once shared that it takes 20 years to build a relationship with somebody and it takes about five minutes to lose it. That’s always stuck with me and that’s my mentality,” he says.

“Over the last year, the shelf space for advisors has been getting so small with different regulations coming down, and the difference in funds can be minimal that if you have that strong relationship, in time you’ll earn the business. Earning it is the key thing and not necessarily hoping something lands.”

In the leadup to taking on his current role, Soubry went back and forth from his previous base in Saskatchewan. Since then, he has made a big effort to get to know the local community, attending events and playing golf.

A determinant in Soubry’s flying start is being on the same wavelength as advisors and clients, which has given him the platform to showcase what he and Dynamic Funds can offer. He notes the commonality of a family-first environment in Atlantic Canada and Saskatchewan.

“What I mean by that is it’s a small community and everybody looks out for each other, which I absolutely love. Once you build off that mentality, things progress from a relationship standpoint. For the most part, advisors have been willing to give me 20 or 30 minutes and I’m really thankful for that,” he explains.

Regional vice president of sales (Western Canada)

Passionate about her firm’s alternative investment solutions, Jamaica Zarchekoff emphasizes the importance of staying informed and collaborating with competitors. Alongside being promoted at the end of 2024, the standout wholesaler brought on 18 new buyers and a new dealer in the past 12 months.

“I set a target for a dozen if I brought on one new buyer a month and to overshoot it, obviously, was great,” she says.

Signing the new dealer involved Zarchekoff tapping into a multiple-year relationship with an advisor to arrange a presentation that was broadcast across all the dealer’s branches in Canada.

“I led it and brought in the PMs to do some discussions, and then did a Q&A after. After that, there was enough interest from advisors that we were able to get approved on their platform.”

Not only an industry leader, Zarchekoff is a student of the game. She grew up with her father and uncle as financial advisors and would receive share certificates every Christmas. This shaped a natural curiosity.

She explains, “If I have a lot of advisors bringing up a certain fund that they’re all looking at and if I don’t know enough about it, I start doing my own research. A lot of the time, it starts by adding it to my own portfolio and seeing how it goes from there.”

Zarchekoff was drawn to Invico due to it having a renowned and successful female CEO, Allison Taylor. This aligns with one of her own personal goals to encourage and be a role model for other women.

“I’m absolutely about doing anything I can do to get people to think about going into finance. We need to see more women in these roles, and it’s not broadly talked about. If it wasn’t for the fact that my dad and uncle were financial advisors, it wouldn’t have been on my radar,” she says.

In her graduating class, there was only a handful of women, which is a situation that hasn’t changed.

Zarchekoff comments, “Even still, I’d say over 90 percent of my clients are men. It’s always been tough and you have just got to keep pushing forward, believe in yourself, and promote the next generation of women.”

Another strength that the regional vice president possesses is a self-confidence that allows her to often collaborate with other wholesalers. It has established her as a go-to name and underlines her professionalism.

“There’s room for all of us and they may have some contacts that I’m not familiar with, and the same with myself. The clients that already do business with me, I’m not worried about losing them,” says Zarchekoff.

“I’m happy to do an introduction to other wholesalers as the more we work together, the better. I want everyone in this space to succeed and have no problem collaborating.”

Principal and director (sales)

Kevin Geiger is an advocate of the importance of building strong relationships, mentoring new team members, and operating in a collaborative nature.

Over the past 12 months, as ICM has grown, Geiger has focused on a select group of clients. As market forces have shifted during that time, he has asked them a series of questions about their portfolio construction:

What are you using?

Why are you using it?

What problem is it solving?

“My client base is smaller and has much tighter relationships because as they’ve grown, we’ve grown alongside each other. Those have been my best clients over the years that I’ve been here,” he says.

Relationships are a priority for Geiger. He keeps communication lines open and ensures that he is always in a position to do the best for advisors.

“Somebody once told me 20 years ago when I started, ‘Whatever you do in this industry, don’t burn bridges.’ It’s a small industry, and I’ve seen relationships that were 10 years old coming back to life just because people have moved on,” he says. “They’ve gone to different firms or changed their approach and even become portfolio managers. You never know.”

However, he doesn’t build relationships with an eye on profit.

“I’m at a point in my life where I’m genuinely interested in people. I’ve got my little circle of family, we do certain things and think certain ways,” Geiger explains. “But the world is a big place. Everybody’s got their own worldviews and interests. I’m a very inquisitive and curious person, and that translates into business.”

A standout attribute of Geiger’s is having fulfilled several roles at ICM. He understands the business from the inside and can leverage this to benefit advisors and team members.

He says, “When I joined, we were a small firm. I’d say we’re medium sized now and I’ve worn a lot of hats. I know our business so deeply and I’m now a minority owner. I have those relationships with the managing partners and understand the relationship between our sales and analytical teams.”

Wholesaling is where Geiger comes alive. He describes the job as “the greatest gig in the industry” and admits that it flicks a switch.

“I’m just so involved. It’s not just being a wholesaler – it’s everything from product development to national accounts and working with product review committees and investment committees. It’s a busy role, but it’s why I wake up in the morning.”

Vice president, sales

A former university football athlete, Kesrick Wainwright stands out for being able to rise to the challenge and devise strategies to manage high expectations while delivering exemplary service levels.

He also cites Wayne Gretzky’s famous phrase: “You miss 100 percent of the shots you don’t take.” This mindset is why Wainwright relishes being on the frontline, offering diversified long-term investments in workforce housing, self-storage, and farmland across North America.

“Being in finance, you know that capital never sleeps. You’ve got to compete, and if you want to see your name in the lights and want to win all the time, this is definitely the sport to be in,” says Wainwright.

The last 12 months have seen him maintain a frenetic pace.

“We’re in a contact sport and there’s not enough time in the day,” he explains. “Being a person that likes to compete, it’s tough because I want to meet with all my partners as many times as I can and host as many events as possible.”

Another link to Wainwright’s sporting past is a talent for fostering team spirit to help colleagues succeed.

He says, “It’s a situation where you’re only as strong as your weakest link, and everybody in our team is extremely strong. I don’t have an ego where I’ve got to be hands-on all the time. I trust everybody to do what they’re responsible for.”

Wainwright remains positive no matter what challenges he faces, which is sometimes due to the hangover from bad actors in the alternative space.

“I love my job and I love real estate,” he says. “Once people realize the experience of working with our team and they liken the real estate investment to their day to day, either renting or ownership, they get comfortable with our products pretty quickly.”

Wainwright adds, “It’s a situation where we’re able to share the returns, but we take away the headache of managing these assets.”

Proving how hard work pays dividends, the star wholesaler reveals he is drawn to check on leads and update clients relentlessly.

“We’re going 100 miles per hour every single day. As soon as I open my eyes, I feel I have to get to the computer or my phone,” shares Wainwright. “I love interacting with everyone and playing my part on the team, as we feed off of each other in terms of support.”

District vice president

Managing a large territory across Saskatchewan, Adrian Hawkings emphasizes the importance of organization, efficiency, and personal relationships. Not only looking after clients spread across the province, Hawkings manages BDMs and associates.

“I have multiple city centers and have to be as organized as they come,” he says.

The giant geographical responsibility is less daunting for Hawkings, after growing up in a similar setting in Whitehorse in Yukon.

“Sometimes it means getting up at 3 AM or driving until midnight,” he says. “I told myself, I’m going to be the one to go to these smaller towns, even the really rural areas, because those are the types of people that I grew up with where we didn’t have access to the same sort of financial services as other people. I was always going to make that a priority and once I showed up, I kept going back.”

That’s not to say Hawkings doesn’t use videoconferencing, which is a must due to the expanse he covers, but he makes a point of touching base in person regularly. The key to his mastery of Saskatchewan has been strategic excellence. His travel schedules are tight and no time is wasted.

“I can sometimes drive six hours to see two or three people. I also do a lot of categorizing opportunities,” he says. “I always say I like to do business with people who are interested in working with me and have the potential to bring business to the firm. That’s who I want to work with.”

Understanding his market in meticulous detail is the missing piece that has enabled Hawkings’s success. As he criss-crosses his territory, he is armed with a range of products and is rarely unable to fit something to an advisor’s needs. Hawkings attributes this to McKenzie’s approach and legacy.

“They invest an incredible amount in their wholesalers and are Canadian owned, along with operating in and having a long Canadian history,” he explains. “We’re focused on helping advisors, and if someone’s interested in hearing about product ideas from third-party asset managers, then I have something for everyone, right from the smallest advisor to the largest. We have a broad shelf and unique solutions across asset classes.”

All the winners rely on contacts, colleagues, and clients to be successful. Below, they share how they go about creating an environment in which to operate and represent their firms.

Cedric Soubry: Advisors are using more and more proprietary products and there are different regulations coming down. But I’m just so happy to help advisors and individual investors grow their wealth, be able to retire, and afford that cottage or whatever the case is. I truly look at it from a relationship standpoint. I want to be part of their success.”

Jamaica Zarchekoff: “Doing cold calls and having three or four bad ones in a row can start to weigh on you. I shake it off, take a minute and start again. You have 30 seconds to make a first impression over the phone and you can’t lose confidence. You have to be able to hold your own. A lot of the times, when I am meeting with a new advisor, if it’s not a fit, I always ask, is there someone in your office you think might like a product like ours? I’m always asking, ‘Who do you think I should be talking to?”

Kevin Geiger: “The pockets of people I work with are all excited to share contacts and information. I don’t know if that’s just the stage of my career or the stage my clients are at – or maybe a confluence of those things. My clients are super excited to help me find new clients and I’m excited to help them. I’m constantly opening the door for new conversations.”

Kesrick Wainwright: “If I hear a ‘no,’ then I don’t mind, or if that person says, ‘Never call me again,’ it’s just one of those things. You’ve got to put your head down and keep moving forward. You need to be respectful of everybody’s time, but you’ve also got a job that you need to do, and that goal for me is to make everybody hear the good word of Avenue Living. That motivates me to push harder. I don’t mind hearing ‘no’ as my goal is to see what their pain points are and how Avenue Living can alleviate some of them.”

Adrian Hawkings: “I don’t just tell my team, ‘Hey, book me some meetings for next week.’ They need to know who to call. There’s a strategy around who you’re seeing, when you’re seeing them, and where you’re seeing them. Some people prefer virtual, others like a morning meeting. You’ve got to know those things because it allows you to be efficient, but also to respect how advisors like to do business. That strategy around it is critical and often overlooked.”

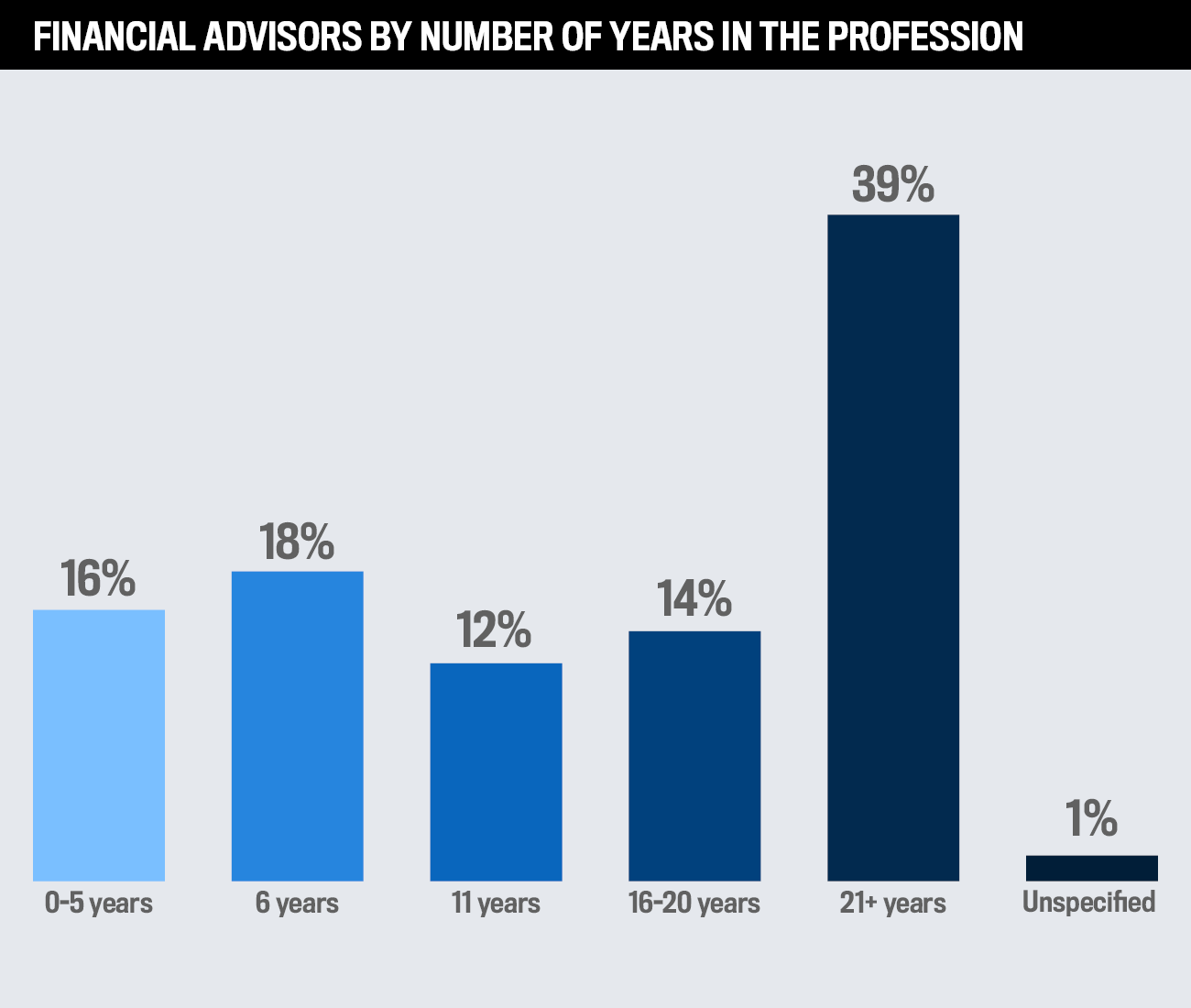

To uncover the best wholesalers in the Canadian wealth management industry, the Wealth Professional team undertook a rigorous marketing and survey process, leveraging WP’s connections to thousands of advisors across the country.

Advisors were asked to nominate their wholesalers for consideration and rate them on their product knowledge, communication, response time, accessibility, understanding of the advisor’s business, ability to educate the advisor, and the value they contribute.

The WP team then invited the nominated wholesalers to explain how they have achieved excellence, demonstrated significant, observable growth over the past 12 months, and contributed value to advisors, overall client service, and relationship management.

The team named the Top 50 Wholesalers based on the service they provide to advisors and how each individual has made a meaningful and tangible difference in the financial services industry.