Investment firm makes absolute return-oriented strategies even more accessible to Canadian retail segment

Mackenzie Investments has announced reduced management fees for three of its alternative mutual funds.

The investment firm has cut fees by 15 to 20 basis points for the Mackenzie Credit Absolute

Return Fund, the Mackenzie Global Macro Fund, and the Mackenzie Multi-Strategy

Absolute Return Fund, which it introduced in May 2018 as the first absolute return fund for Canadian retail investors.

The changes affect series A, F, FB, and PW units of the funds; series F units include series PWFB and PWX.

“It's more important than ever right now to provide affordable and innovative investment options to Canadian retail investors,” said Mackenzie Investments President and CEO Barry McInerney. “Reducing the fees on these funds further supports our commitment to providing competitive, simplified and transparent pricing.”

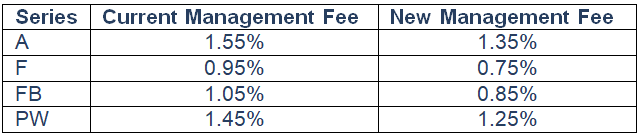

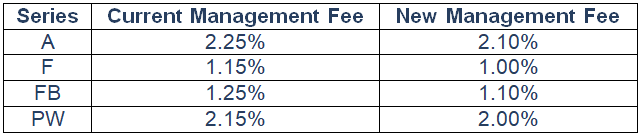

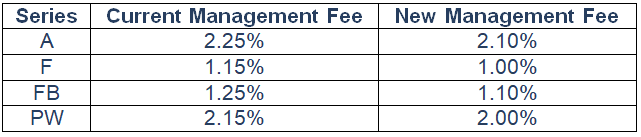

The previous and new management fees for the funds and the impacted units are:

Mackenzie Credit Absolute Return Fund

Mackenzie Global Macro Fund

Mackenzie Multi-Strategy Absolute Return Fund

“Funds that employ absolute return-oriented investment strategies may be particularly attractive in the current market environment because they include non-directional strategies which aim to be independent of market fluctuations,” said Michael Schnitman, senior vice president and head of Alternative Investments at Mackenzie Investments.

Aside from their relatively lower sensitivity to broader market variations, Schnitman said strategies that are focused on absolute returns provide opportunities for enhanced diversification.