CEO of Brookfield Oaktree Wealth Solutions explains the growing appetite for alts among high net worth investors and their advisors

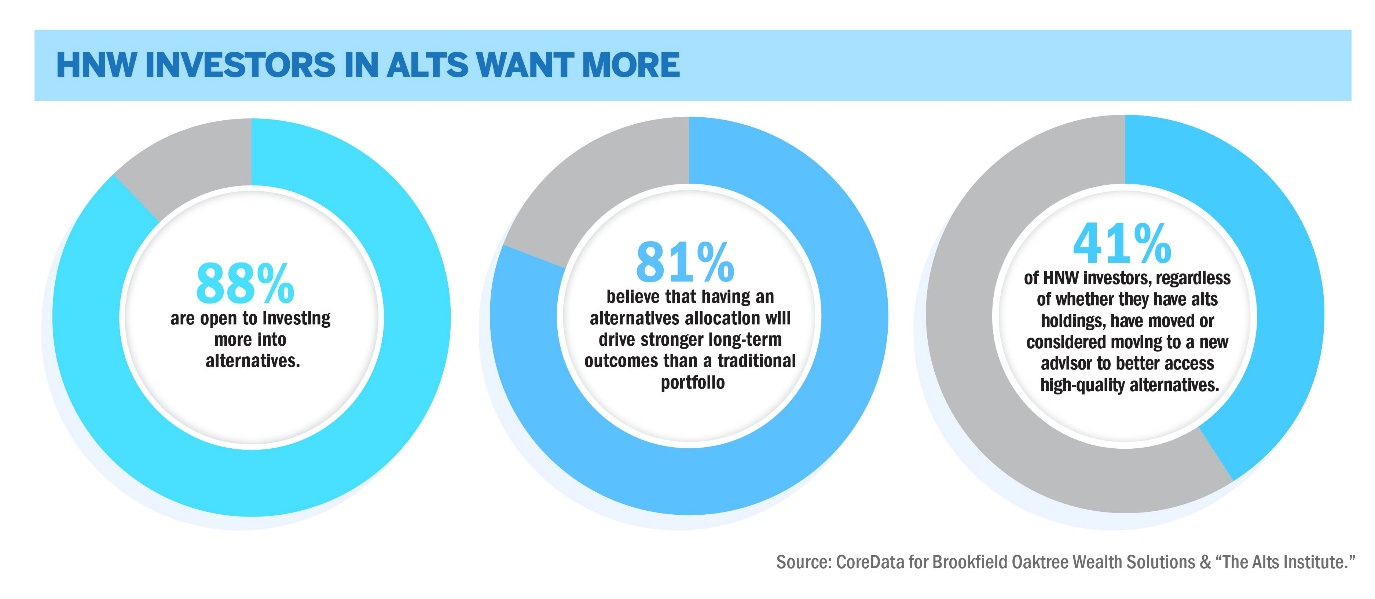

A survey conducted for Brookfield Oaktree Wealth Solutions earlier in Q4 revealed what much of the industry already knows to be true, high net worth (HNW) investors in Canada and the US want alternative allocations. The survey of HNW investors — defined as investors with at least $2.5 million (USD) in investable assets — and HNW advisors — with an average of $633 million (USD) in assets under management — found that those who allocated to alternatives wanted more and those who didn’t have allocations yet wanted more. The survey even found that many investors would switch advisors for better access to alternative products.

With an appetite so large for these investments, two key questions arise: what’s driving it, and what’s it impacting. John Sweeney, CEO of Brookfield Oaktree Wealth Solutions, explained the former and outlined some of the latter. He noted the much-touted impacts of diversification and return profiles, while highlighting some other aspects of the appeal. He noted the parallels between these allocations among the HNW segment and how institutions have already adopted alternatives, as well as the limitations that liquidity requirements inherently place on a mirrored approach. Fundamentally, he emphasized that the HNW investor and advisor segment will continue to be a growing force in private markets going forward.

“I think people are interested for the right reasons. By that I mean it's not just about return enhancement. I think folks have started to appreciation the appreciate, the diversification benefits that alternatives can bring to a portfolio,” Sweeney says. “So even if you're looking at similar yield or similar return profiles, generating that return, generating that yield from different sources. That's what I think advisors are trying to deliver to their clients, whether it's stability of returns, whether it's inflation protection, whether it's private credit, to add more stability in your portfolio. What I've seen maybe over my 25 years in alternatives, we've gone away from just looking to my alternative portfolio purely for return enhancements. Now we think about what incorporating alternatives broadly can do for a portfolio.”

That way of thinking about alternatives, Sweeny says, is rooted in the history of institutional asset management, with greater focus on creating highly differentiates sources of return than simply maximizing return in any given year. He argues that this approach produces better long-term outcomes. It’s an approach which is being bought into by the HNW segment and through new, more liquid, vehicles is even growing in the mass affluent retail segment.

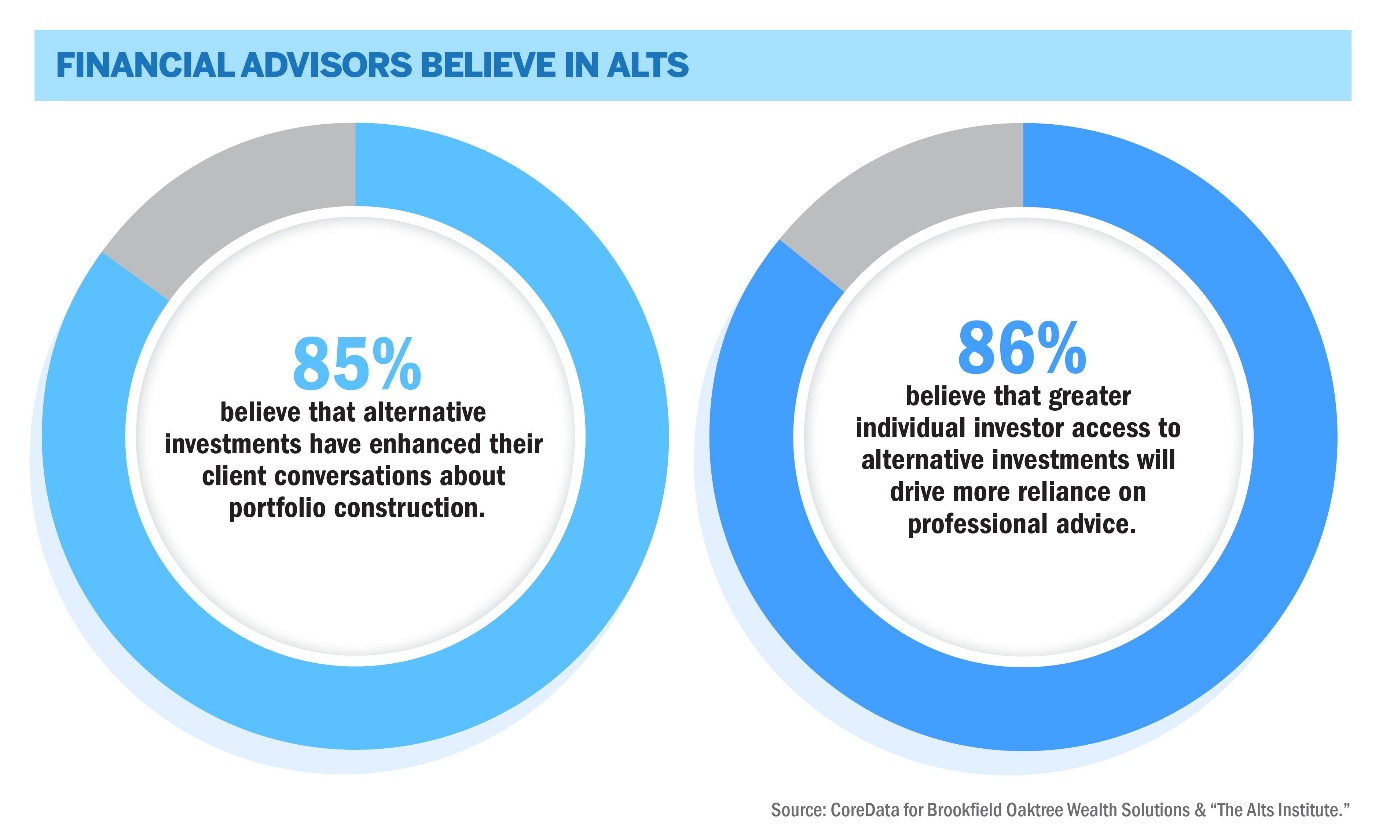

Just as HNW and retail investors claim greater interest in alternatives, Sweeney says that there is greater sophistication in the products they’re demanding. That sophistication has grown to the point where using alternatives as a broad term has almost become obsolete. Financial advisors and their clients, Sweeney says, are having direct conversations about real estate, real estate debt, private credit, private equity, secondaries, venture, hedge funds, and just about every other conceivable flavour of private asset. It’s a growing sophistication which Sweeney says also mirrors the earlier entry of institutional investors into various alternatives subcategories.

Where retail and institutional demand has diverged, notably, is on income-generating real estate assets. While both market segments have allocated there, Sweeney says that retail investors and advisors have shown considerable appetite for income generating investments. That began with REITs but has since spread out to private credit. There is even a growing appetite among HNW investors for access to infrastructure.

Sweeney notes that there hasn’t been much appetite for infrastructure among wealth management clients historically. This new uptick, though, stems more from that institutional mindset. These HNW investors are looking to add infrastructure exposure because of the ballast it provides to their portfolios, rather than its possible upside. They’re doing so, too, during a historic bull run with public equities offering gargantuan returns. The mindset, Sweeney says, is less about FOMO on the equities run, and more a seeking of protection against the data-sensitivity, geopolitical uncertainty, and challenging circumstances that seem to drive an elevated level of market volatility.

That is not to say Sweeney doesn’t see upside in various alternatives categories. He believes that even in infrastructure, the rise of AI could create huge opportunities for power generation and transportation assets. Renewables, he says, are quite promising within that realm. Broadly speaking, though, he believes that the appetite for alternatives among the HNW segment reflects the core value of diversification long since identified by institutions. Interestingly, he is of the view that their entry into the alts market does not put retail investors up against institutions. Rather, he believes there is enough space for all.

“More capital in the space over time can impact pricing, it could impact availability but I don't think we're any we're near that,” Sweeney says. “If you look at the enormous amount of investment that’s required in infrastructure, for example, whether it’s institutional or high net worth capital I don’t think it will have any impact [on pricing] in the near term. There is so much more demand for capital than there is even the ability to raise right now.”