Covered call overlays as part of active management strategy to offer amplified returns

This article was produced in partnership with Global X.

Across the world, there are a few equity indices that stand out above others. These benchmarks, including the Nasdaq-100®, the S&P 500®, the MSCI EAFE Index and the MSCI Emerging Markets Index, managed by some of the world’s leading index providers, are widely followed as barometers of economic health, sentiment direction and investment opportunity. These indices include some of the world’s biggest companies, which are driving innovation – and markets – forward.

For Global X Investments Canada Inc. (“Global X”), one of Canada’s largest and long-running ETF providers, these popular indices aren’t just investable, they’re essential, and they’ve built a suite of ETFs around it they deemed their “Equity Essentials”.

Some investors take a two-pronged approach to building their investment portfolio and may allocate some of their exposure to exciting and emerging themes, like cutting-edge technology companies, commodities or specific fixed-income strategies. However, that is typically a smaller part of the overall mix. What very typically constitutes the bulk of investors’ portfolios are allocations to major equity indices, which can offer a more diversified approach and a potentially better risk-return profile through exposure to large-capitalization companies that are well-known and followed.

It can be useful for Canadian investors to consider equity exposure through the lens of geographic distinction: Canada, the United States and International. While there are several indices offering exposure to different countries and regions, the five marquee indices below tend to be heavily weighted within Canadian portfolios, relative to others.

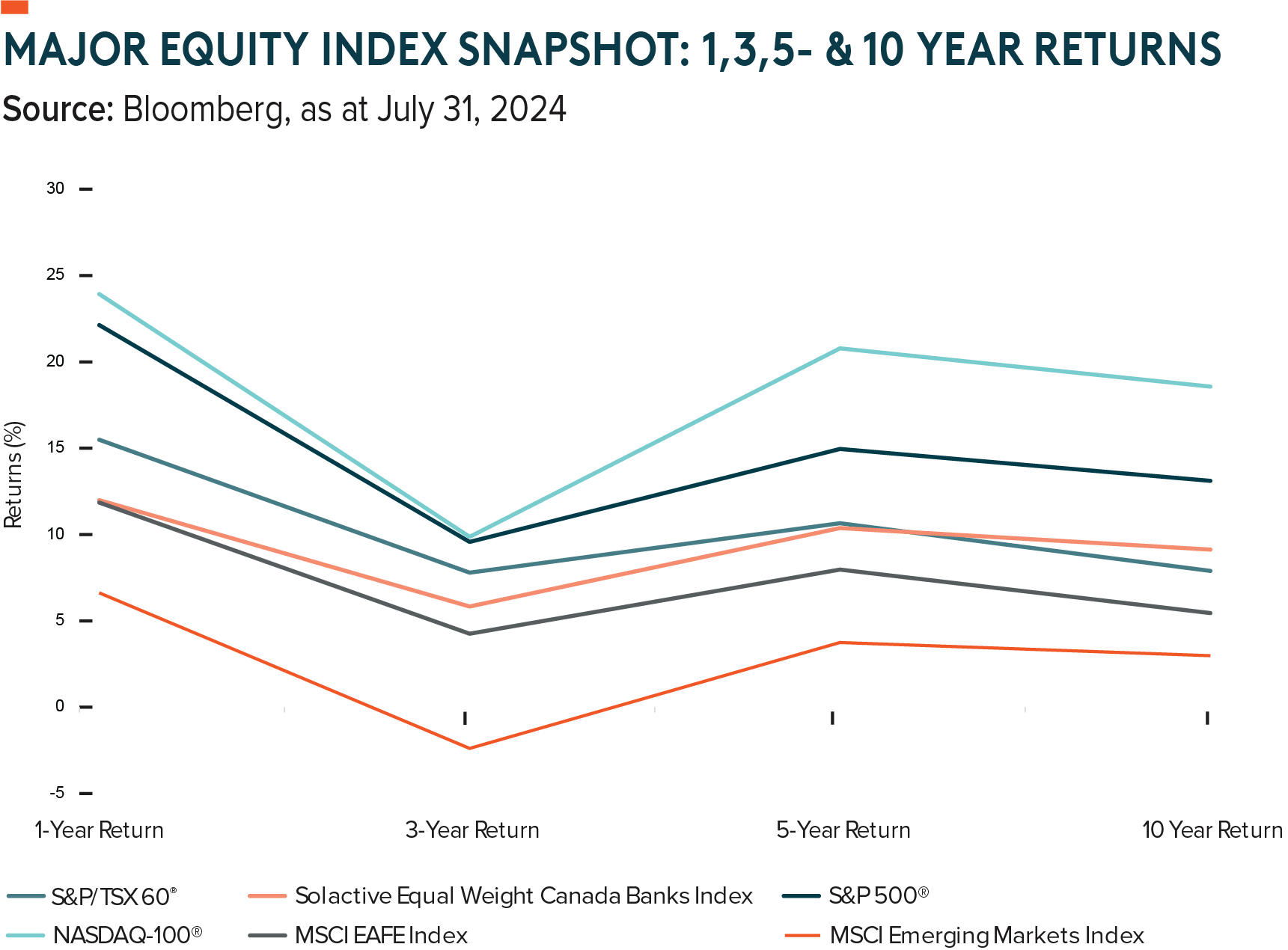

MAJOR EQUITY INDEX SNAPSHOT: 1, 3, 5- & 10-YEAR RETURNS

|

Region |

Index |

1-Year Return (%) |

3-Year Return (%) |

5-Year Return (%) |

10 Year Return (%) |

|---|---|---|---|---|---|

|

Canada |

S&P/TSX 60® |

15.49 |

7.8 |

10.66 |

7.9 |

|

Canada |

Solactive Equal Weight Canada Banks Index |

11.99 |

5.83 |

10.38 |

9.13 |

|

United States |

S&P 500® |

22.13 |

9.57 |

14.96 |

13.12 |

|

United States |

NASDAQ-100® |

23.93 |

9.87 |

20.79 |

18.57 |

|

International |

MSCI EAFE Index |

11.85 |

4.26 |

7.97 |

5.45 |

|

International |

MSCI Emerging Markets Index |

6.62 |

-2.39 |

3.75 |

2.99 |

Source: Bloomberg, as at July 31, 2024

In Canada, more than $46 billion – 12.9% of total ETF assets under management in the country – are invested in the 53 ETFs that track these benchmarks, with trillions of dollars of investor capital allocated globally.

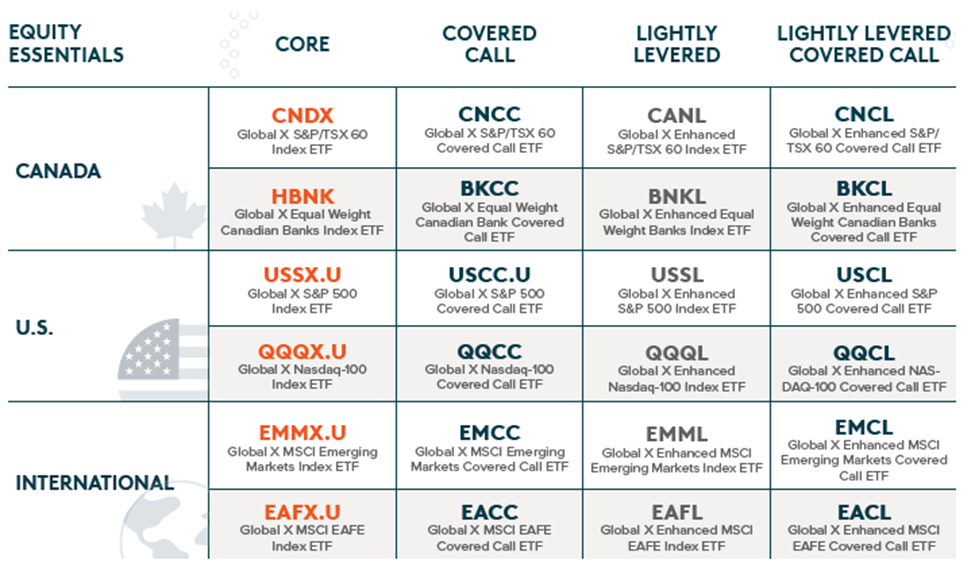

The Global X Equity Essentials ETF Suite

While many ETF providers in Canada have launched ETFs that track these benchmarks, no other company has developed a suite of ETFs offering specialized and differentiated exposure to these indices through strategy overlays.

Each of Global X’s Equity Essentials ETFs uses up to three strategies to help investors optimize their risk exposure and performance potential: Low-cost benchmark tracking, 1.25 times leverage (“1.25x”) to potentially amplify returns, and covered call writing to enhance income. Here’s how they work:

Benchmark

When Canadians think of index investing, they probably think of low-cost benchmark tracking. These investment strategies seek to replicate the performance of an underlying index, whether the S&P 500®, the Nasdaq-100® or others. That index’s performance is the result of the performance of all the companies captured within it and it can typically be had at a low cost, from many ETF providers. There are more than 13 ETFs that replicate the S&P/TSX 60® in Canada (Source: Bloomberg, as at July 31, 2024).

Like other ETF providers, Global X has its suite of low-cost index ETFs that offer exposure to these indices. These ETFs provide the foundation for all of Global X’s Equity Essentials ETFs as well as several other products.

“We know more than 60% of ETF assets are in passive ETFs,” says Alek Riley, Vice President and Portfolio Manager of Product Strategy at Global X. “We built a continuum of strategies around these indexes tailored to investors’ cashflow needs and growth goals. The foundation of the equity essentials lineup is the Core Index ETFs.”

|

Region |

Ticker |

ETF Name |

|---|---|---|

|

Canada |

||

|

Canada |

||

|

United States |

||

|

United States |

||

|

International |

||

|

International |

*Trades in U.S. Dollars

“Enhanced” 1.25x leverage overlay

On each Equity Essentials indices, Global X offers an “Enhanced” ETF version that utilizes leverage, a strategy that can potentially magnify gains and losses. These Enhanced ETFs aim to generate approximately 1.25x the return of their underlying index.

To do this, each of the Enhanced ETFs applies modest leverage to a related ETF managed by Global X, to deliver enhanced income and growth opportunities.

But why choose to ‘enhance’ your investment exposure? A little leverage can go a long way – an enhanced approach can result in a risk-return profile that’s more suitable for a long-term investor with high conviction on a particular market. Also, major index ETFs will typically have less volatility relative to individual securities or sector-focused investments, making them a potentially more stable long-term hold too. With the added benefit of a 0% management fee rebate (until December 31, 2024, plus applicable sales tax), investors can keep more of their earnings and maximize their returns.

“The Enhanced or Lightly-Levered ETFs seek to provide enhanced growth potential by employing 25% leverage,” says Riley. “Investing with leverage is not without risk, but for growth-oriented investors with high conviction on the direction of these indices, there is the potential for long-term outperformance.”

|

Region |

Ticker |

ETF Name |

|---|---|---|

|

Canada |

||

|

Canada |

||

|

United States |

||

|

United States |

||

|

International |

||

|

International |

Covered call overlay

For each of these indices, Global X offers an ETF that employs options-writing as part of an active management strategy, specifically covered call overlays, an investment strategy designed to generate additional income in addition to their underlying index exposure. The Covered Call ETFs seek to generate higher yields relative to their underlying indices and may result in higher levels of monthly income for investors.

Covered calls are an increasingly popular investment strategy for investors who are seeking monthly income in addition to exposure to the Equity Essentials indices. Global X has built one of the most robust covered call suites in Canada, which can help make greater levels of income attainable from index investing, especially when compared to some of these indices, which historically have lower yields, as a result of a lower amount of dividend payers among their portfolios.

|

Region |

Ticker |

ETF Name |

|---|---|---|

|

Canada |

||

|

Canada |

||

|

United States |

||

|

United States |

||

|

International |

||

|

International |

*Trades in U.S. Dollars

“The Covered Call ETFs are intended to offer yield enhancement through an active covered call strategy,” says Riley. “These are better suited to income-focused investors who are willing to give up some upside participation in exchange for a higher yield.”

“Enhanced” 1.25x Leverage & Covered Call Overlay

Finally, there’s an option for investors seeking the potential of both an enhanced approach and a covered call overlay. For each of the Equity Essentials indices, Global X offers enhanced covered call ETFs, which simultaneously offer potentially amplified returns from the light leverage and monthly income from the covered call active management.

“The Enhanced or Lightly-Levered Covered Call ETFs combine 25% leverage with exposure to the covered call strategy. These are the highest yielding across the essentials lineup,” says Riley. “The 25% leverage mitigates the reduction in upside participation that is characteristic of traditional covered call strategies, but you lose some of the downside risk mitigation benefits too. We expect it’s a good middle ground for income-focused investors looking to get more growth potential.”

|

Region |

Ticker |

ETF Name |

|---|---|---|

|

Canada |

||

|

Canada |

Global X Enhanced Equal Weight Canadian Banks Covered Call ETF |

|

|

United States |

||

|

United States |

||

|

International |

||

|

International |

For a complete look at Global X’s Equity Essentials line-up, the table below offers a handy overview of the over 20 ETFs currently in the suite:

Global X is one of Canada’s longest-running and largest ETF providers. With 125 ETFs and more than $34 billion in assets under management, as at July 31, 2024, there’s likely a fund that’s right for you within their ETF family. Learn more at: www.GlobalX.ca.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain ETFs are alternative investment funds (“Alternative ETFs”) within the meaning of the National Instrument 81-102 Investment Funds (“NI 81-102”) and are permitted to use strategies generally prohibited by conventional mutual funds, such as the ability to invest more than 10% of their net asset value in securities of a single issuer, the ability to borrow cash, to short sell beyond the limits prescribed for conventional mutual funds and to employ leverage of up to 300% of net asset value. While these strategies will only be used in accordance with the investment objectives and strategies of the Alternative ETFs, during certain market conditions they may accelerate the risk that an investment in ETF Shares of such Alternative ETF decreases in value. The Alternative ETFs will comply with all requirements of NI 81-102, as such requirements may be modified by exemptive relief obtained on behalf of the ETF.

Effective June 24, 2022, the investment objectives of the Global X S&P/TSX 60 Covered Call ETF (“CNCC”) (formerly Horizons Canadian Large Cap Equity Covered Call ETF), the Global X Canadian Oil and Gas Equity Covered Call ETF (“ENCC”) (formerly Horizons Canadian Oil and Gas Equity Covered Call ETF), the Global X Equal Weight Canadian Bank Covered Call ETF (“BKCC”) (formerly Horizons Equal Weight Canadian Bank Covered Call ETF), the Global X S&P 500 Covered Call ETF (“USCC.U, USCC”) (formerly Horizons US Large Cap Equity Covered Call ETF), the Global X NASDAQ-100 Covered Call ETF (“QQCC”) (formerly Horizons NASDAQ-100 Covered Call ETF), and the Global X Gold Producer Equity Covered Call ETF (“GLCC”) (formerly Horizons Gold Producer Equity Covered Call ETF), were changed following receipt of the required unitholder and regulatory approvals. For more information, please refer to the disclosure documents of the ETFs at www.GlobalX.ca.

Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and have been licensed for use by Global X Investments Canada Inc. (“Global X”). The Global X ETFs are not sponsored, endorsed, sold or promoted by S&P, and S&P makes no representation, warranty or condition regarding the advisability of buying, selling or holding units/shares in the Global X ETFs.

Nasdaq®, Nasdaq-100®, and Nasdaq-100 Index® are trademarks of The Nasdaq Stock Market, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Global X Investments Canada Inc. The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S).

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Global X Investments Canada Inc. (“Global X”) and any related funds.

All trademarks/service marks are registered by their respective owners. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Global X ETFs. Complete trademark and service-mark information are available at https://www.GlobalX.ca/legal/Trademarks.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the "Global X Funds") managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.