Management fees reductions announced amid portfolio change to 'protected' asset mix

BMO Investments Inc. (BMOII) has announced a change to the portfolio allocation of one of its target-date funds.

The BMO LifeStage Plus 2030 fund has been moved to a “protected” asset mix, consisting entirely of provincial and corporate fixed-income investments as well as cash equivalents until its target end date.

The reallocation was made in accordance with the fund’s investment strategies, with the aim of ensuring that investors in the fund are paid the guaranteed maturity amount at the target end date of the fund. Investors who redeem their units prior to the target-end date were advised that they will receive the price per unit based on the relevant series NAV determined after BMOII receives the redemption request, which may be less than the guaranteed maturity amount.

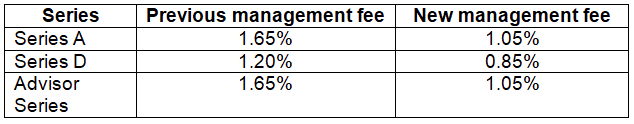

Because of the change, BMOII has also reduced management fees for certain units of the fund:

The fee reductions were effective as of the close of business on August 10.