Tax on RRSP withdrawals come at a steep cost but there are alternatives. Learn the different ways to reduce tax penalties on RRSP withdrawals in this guide

When used correctly, your registered retirement savings plan (RRSP) can serve as an effective tool to save for your retirement. But sometimes, life throws you a curveball and your RRSP may seem the most convenient source of an emergency fund.

While tapping into your RRSP can be an easy way to access much needed money, there are consequences for doing so. The biggest drawback of withdrawing from your RRSP before you retire is the substantial tax penalties that go with it. That’s why this option should only be considered as a last resort.

In this article, Wealth Professional discusses how tax on RRSP withdrawals work and how much these taxes can cost you. We will also list ways to minimize these taxes.

If you need money for an emergency and are seriously considering withdrawing from your RRSP, this guide can help you make an informed decision. Read on and learn more about how taxes work on early RRSP withdrawals.

How do RRSP withdrawals work?

You can withdraw funds from your RRSP whenever you want to. The only exception is when the funds are in a locked-in plan. Also called a locked-in retirement account or LIRA, the funds here can only be used as retirement income.

As mentioned, tapping into your RRSP early comes with tax implications.

First, your withdrawal is subject to withholding tax. The rate depends on the amount you withdraw and where you live.

Find out what is the RRSP withholding tax rate and how does it work in this article.

Secondly, the funds count as your income – you'll have to declare them in your tax return. This can end up placing you in a higher tax bracket, increasing the income tax you’ll pay.

That’s why it’s advisable to wait until you retire before withdrawing money from your RRSP. When you retire, your income typically decreases. This means that even if you add your RRSP withdrawals to your total income for the year, the amount is low enough to keep you in a lower tax bracket.

You can only keep your RRSP until you reach the age of 71. At this point, your plan is considered to have reached maturity and you are then required to close it by the end of the calendar year. You have three options on how to do this:

- Withdraw the funds, bearing in mind the tax on RRSP withdrawals

- Convert your RRSP to a registered retirement income fund (RRIF)

- Purchase an annuity

We will discuss these three options in more detail later. But if you want to learn more about how registered retirement savings plans work, you can check our comprehensive guide to RRSPs.

How much is tax on RRSP withdrawals?

Every time you make an RRSP withdrawal, you are taxed twice. These are done through:

- A withholding tax

- Your income tax

Withholding tax on RRSP withdrawals

When you make a withdrawal from your RRSP, the financial institution that you’re transacting with withholds the tax. The withholding tax rate depends on where you live and the amount that you’re withdrawing.

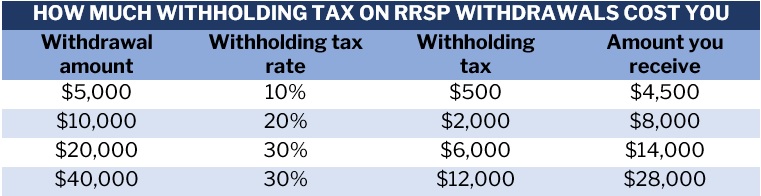

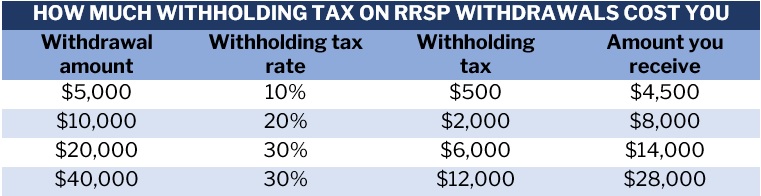

The tables below detail how much taxes are withheld from RRSP withdrawals of Canadian residents, according to the Canada Revenue Agency’s (CRA) website.

The withholding tax rates for Quebecers are slightly lower, but they are also charged a provincial withholding tax. You can find more information about the province’s tax rates on the Revenu Québec website or by contacting your financial institution.

Non-residents, meanwhile, typically pay 25% in withholding taxes. This is unless the taxes are reduced by a tax treaty between Canada and their country of residence.

Currently, Canada has tax treaties with 94 countries and territories.

Calculating withholding tax on RRSP withdrawals

Your financial institution deducts withholding tax automatically, so you don’t have to worry about calculating it yourself. But to give you a picture of how much the tax on RRSP withdrawals can cost you, here’s a sample calculation for Canadian residents, excluding Québec.

As you may have noticed, the cost of withholding tax on RRSP withdrawals can be quite steep. Additionally, you will need to factor in these tax rates if you need the full amount that you’re withdrawing. If you want to receive $10,000, for example, you will need to withdraw $12,500. This, however, raises your withholding tax to $2,500.

Withholding taxes still apply if you withdraw your funds upon your RRSP’s maturity.

How RRSP withdrawals impact your income tax

Your RRSP withdrawal counts as part of your taxable income for the year, so you may have to pay more in income taxes. Depending on the amount, your withdrawal may also put you in a higher tax bracket, increasing your income tax further.

But since income typically decreases significantly upon retirement, retirees might not have to worry about going up the tax bracket. RRSP withdrawals are still considered part of your taxable income even if you withdraw the funds upon your plan’s maturity.

How can you avoid paying tax on RRSP withdrawals?

There are generally two ways for you to avoid incurring tax on RRSP withdrawals, but these come with stringent eligibility requirements. These are:

1. Through the Home Buyers’ Plan (HBP)

If you’re a first-time home buyer, you can withdraw up to $35,000 from your RRSP that you can use to purchase your home under the HBP scheme. If you’re married, you and your spouse can withdraw this amount separately, so that’s a total of $70,000 of funding for your new home.

This type of withdrawal is tax-free, but you need to pay back the full amount in 15 years. Repayments begin in the second year after the withdrawal. Each year, the CRA will send you a statement, which includes your HBP balance and the payments you’ve made.

You are required to pay back one-fifteenth or 6.67% of your RRSP withdrawal each year. This means if you withdrew $35,000, you would need to make yearly payments of $2,334.50. Failure to do so triggers a penalty from the CRA.

Learn how a first-time home buyer can use the RRSP in this article.

2. Through the Lifelong Learning Plan (LLP)

If you, your spouse or common-law partner is going back to school, you can make a tax-free withdrawal from your RRSP to fund your full-time education or training.

The LLP withdrawal amount is capped at $10,000 per year, with a lifetime maximum of $20,000. Canada residents with disabilities can also withdraw the same amount for part-time programs. However, you are not allowed to use this type of RRSP withdrawal to finance your child’s education.

You must return the funds in 10 years, at a 10% rate per year. Repayments start once your eligibility as a student ends. The CRA will send you a yearly notice, stating your LLP balance, repayments made, and the next payment amount.

Under the program, you are still required to file an income tax return and designate your LLP payment on Schedule 7.

Learn more about Canada Revenue Agency’s (CRA) notice of assessment in this article.

How can you mitigate tax on RRSP withdrawals?

If you don’t qualify for the programs above, there are still ways for you to decrease the tax on RRSP withdrawals. Here are two of the most popular ways.

1. Transferring RRSP funds to RRIF

One effective strategy of mitigating tax on RRSP withdrawals is to let it mature and convert it to RRIF. The funds will still be considered taxable income, but at least you don’t have to worry about exorbitant early withdrawal charges.

2. Opening a TFSA

You can also consider putting some of your retirement savings in a tax-free savings account (TFSA). This way, you can make unlimited withdrawals without incurring tax penalties.

Any interests, dividends, or capital gains earned on investments in your TFSA are tax-free. This applies while the funds are held in your account or when they are withdrawn.

You can learn more about the key differences between RRSPs and TFSAs in this guide.

What are the drawbacks of early RRSP withdrawals?

Dipping into your RRSP before retirement may be a fast and convenient way to access funds for an emergency, but it has its drawbacks. These include:

- Costly tax on RRSP withdrawals: By withdrawing from your RRSP, you incur costly withholding taxes and may increase the amount you need to pay on income tax. This means you are taxed twice for each RRSP withdrawal.

- Impact on government-sponsored benefits: Early RRSP withdrawals can reduce the amount you can receive from government-sponsored programs such as Old Age Security (OAS) pensions and Guaranteed Income Supplement (GIS). Depending on your tax bracket, the benefits you receive could decrease by half.

- Missing out on the benefits of compound interest: Your RRSP works best if you put in steady long-term contributions as your savings grow because the interest you earn also earns interest, and so on. This process is called compounding. If you withdraw early, you lose most of this benefit.

- Permanently losing your RRSP contribution limit: Once you withdraw from your RRSP, you permanently lose your contribution limit. This decreases the potential value of your savings when you retire. You can learn more about how your RRSP contribution limits work in this guide.

What happens when your RRSP matures?

Your RRSP reaches maturity on the 31st of December of the year you turn 71 years old. At this point, you should have closed your account and dipped into your savings. As mentioned earlier, you generally have three options on how to go about this process. These are:

1. Making a lump-sum RRSP withdrawal

You can opt to withdraw the entire amount of your RRSP as a lump sum. This, however, is the least attractive option. RRSP withdrawals, even if these are done after maturity, are subject to taxes. Withholding tax rates still apply and the money still counts as part of your income tax.

2. Converting your RRSP to RRIF

RRIF allows you to have a steady flow of retirement income. You are required to make minimum withdrawals each year. These withdrawals are still considered part of your taxable income but aren’t subject to withholding taxes unless these exceed the minimum amount.

The main drawback of an RRIF is that your withdrawal rate might exceed your returns. This means you could eventually outlive your savings.

3. Purchasing an annuity

Converting your RRSP to an annuity allows you to receive guaranteed income for a certain period or your lifetime. The amount you spend on purchasing an annuity is exempt from withholding tax, but you may need to include the benefits you receive in your income tax returns.

Is making early RRSP withdrawals worth it?

The biggest consequence of withdrawing funds from your RRSP early is the substantial tax penalties you incur. Withholding taxes come at exorbitant rates. Combined with the increase in your taxable income, you can end up losing more.

There’s a reason why RRSPs are aptly called “retirement savings.” They work best when your contributions are allowed to grow long-term, increasing in value through compounding. Early withdrawals hamper the ability of your retirement funds to grow as you won’t be able to regain the contribution limit that you’ve lost.

RRSP withdrawals should be taken only as a last resort to protect the funds you have steadily built during your working years.

You can find more helpful information about retirement investments in our Retirement Solutions News section. Visit and bookmark this page for breaking news and the latest developments within the sector.

Given the tax on RRSP withdrawals, do you think this option is still worth considering? What alternatives do you have if you need emergency funds? Feel free to share your thoughts below.