Two funds showed significant improvement, but Shift says there's a long way to go

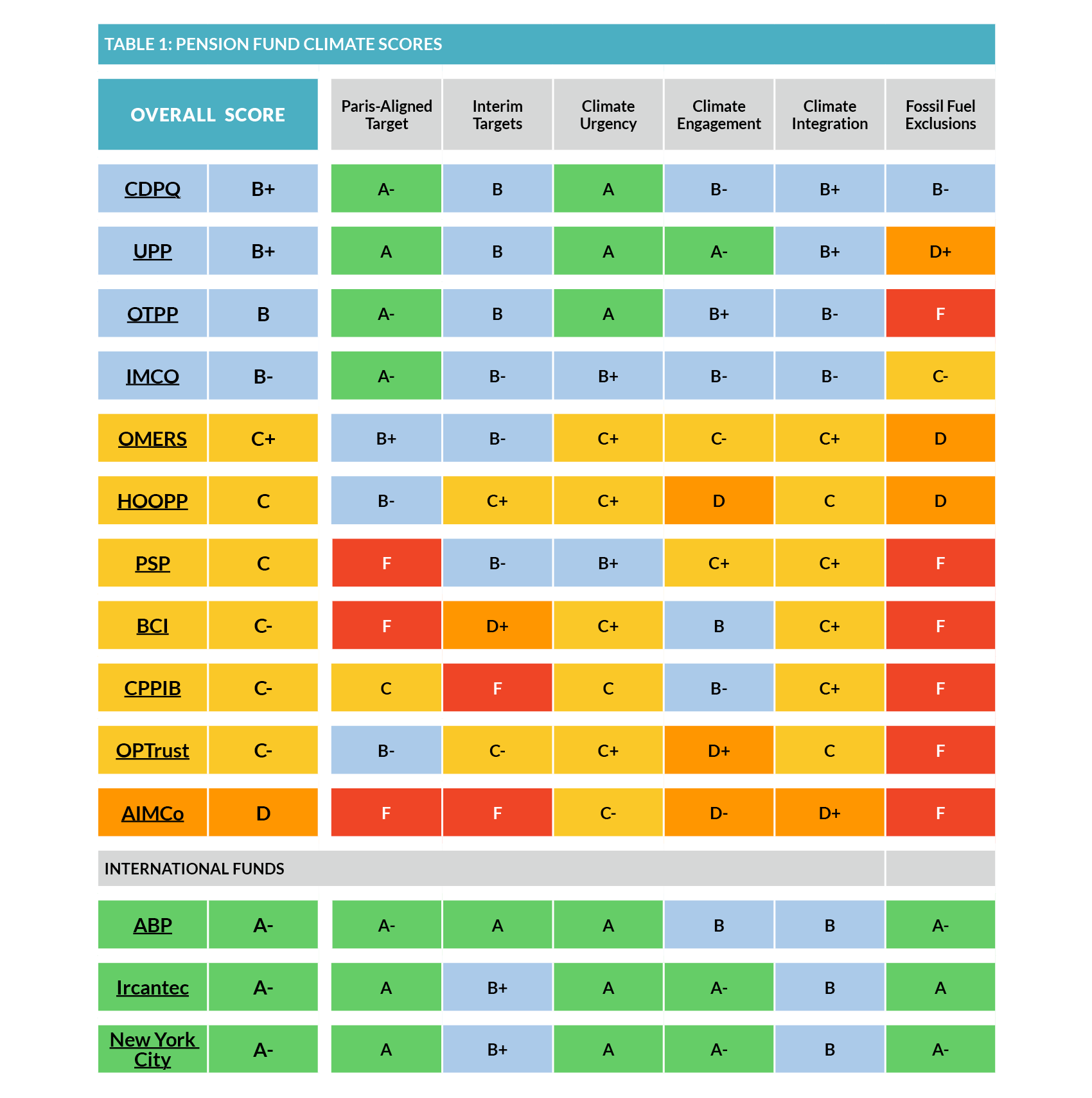

Canada’s pension funds have shown some improvement in plans to address climate change, but are lagging their global peers, according to a new report.

The Canada Pension Climate Report Card, published today (Feb. 28) by Shift Action for Pension Wealth and Planet Health, is an independent benchmark for evaluating the quality, depth and credibility of climate policies for 11 of Canada’s largest pension managers.

It revealed that four of the eleven fund managers included do not have targets to reduce emissions by 2030 or 2050 and seven have at least one director or trustee who is concurrently a director or executive of a fossil fuel company.

Two managers showed significant improvement having lacked climate strategies in 2023. They were the Ontario Municipal Employees Retirement System (OMERS) and the Healthcare of Ontario Pension Plan (HOOPP).

However, Shift says that The Canada Pension Plan Investment Board (CPPIB) had worse scores in its latest analysis compared to 2023, with a “pattern of problematic public statements” and new investment in fossil fuels.

“Despite a summer that saw smoke-filled skies blanket Canadian cities and some of the worst air quality in the world, last year most of Canada’s pension managers acted as though climate action is not an urgent concern,” said Laura McGrath of Shift. “For the majority of Canadian pensions, there is a mismatch between the incremental pace of climate progress and the need for urgent action to prevent irreversible climate breakdown. What more will it take for Canadian pensions to recognize that their legal mandates will be impossible to fulfill in the long-term unless the climate is stabilized at safe temperatures?”

The report comes as a recent survey found that a significant portion of large Canadian institutional investors are gearing up to launch impact funds focused on climate-change solutions this year.

International peers

The Shift report looks at how Canadian pension managers are faring compared to peers in the United States, France, and the Netherlands.

“Leading international pension funds recognize there is no credible or profitable pathway for engaging fossil fuel producers to act in line with climate safety,” said Patrick DeRochie of Shift. “These international funds have each moved to screen out new fossil fuel investments while phasing-out existing holdings, shifting an increasing share of capital into safer, cleaner and rapidly growing investments in climate solutions. Canadian pension managers need to catch up – and stop pouring members’ retirement savings into companies that are accelerating the climate crisis.”

While many Canadian pension managers have increased engagement with the companies they invest in regarding climate impact, the report says the quality and ambition of these strategies varies.

The report calls on funds to reconsider how their manage Canadians’ retirement savings and develop credible plans to address the climate crisis.