New insights from behavioural finance can lead advisors to stronger client relationships and better outcomes.

This article was provided by Canada Life.

Market conditions are fueling Canadians’ concerns, and emotions are running high. Understanding what matters most to them can help. In this report from Canada Life Investment Management, you’ll gain insights from behavioural finance that can lead you to stronger client relationships and better outcomes.

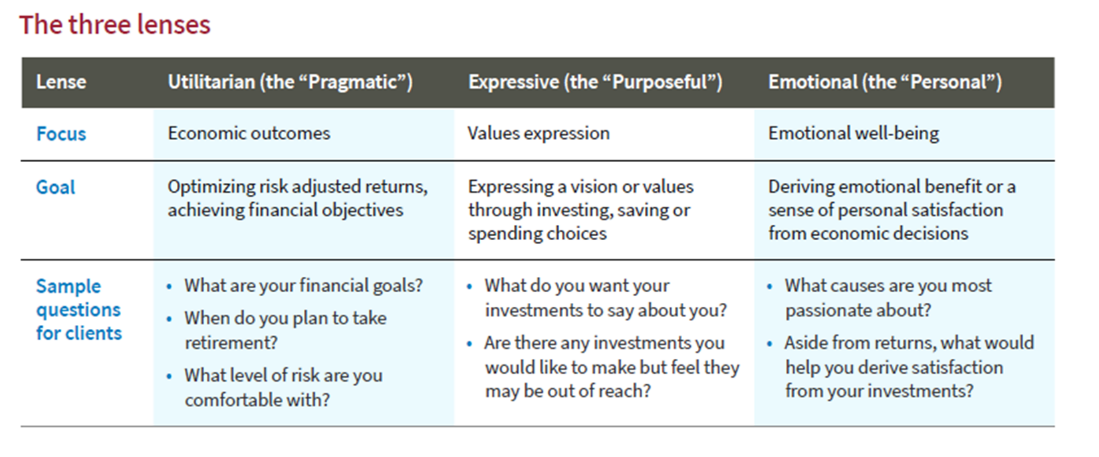

While early financial theory assumed that our economic decisions are geared towards optimizing risk-adjusted returns and little else, this approach greatly simplifies the reality of human experience. A second generation of behavioural finance has emerged in recent years that has attempted to capture this dynamic and provide a more holistic – and realistic – perspective. As described in Behavioral Finance: The Second Generation (2019), by Meir Statman, PhD, it suggests there are three perspectives, or lenses, through which we view economic decisions: utilitarian, expressive and emotional.

Clients benefit greatly from working with an advisor that “gets them.” Using the three lenses of behavioural finance to better understand clients and how they view investments is one way to do this. In fact, a recent survey showed that clients who manage their own portfolios had a harder time keeping emotions in check, reported higher rates of lost sleep and were more likely to regret an investment decision based on emotions.1

“Advisors who apply the latest behavioural finance insights in their practices provide a differentiated and enhanced client experience – one that balances valuations with values, and earnings with expression. With an attentive approach and a modern array of purpose-built investment strategies and tools, advisors can build multi-dimensional plans and portfolios that are designed to meet their clients’ financial expressive and emotional needs all at once.”

Paul Orlander, Executive Vice-President, Individual Customer, Canada Life

Get the report to learn how behavioural finance principles can enhance your practice.

1 MagnifyMoney survey of 668 consumers who self-manage their investments and 352 consumers who use a financial advisor for investment management, conducted June 24-29, 2021.

This material is for advisors and not intended for use with clients.

The views expressed in this commentary are subject to change without notice. This commentary is presented only as a general source of information and is not intended as a solicitation to buy or sell specific investments, nor is it intended to provide tax or legal advice.

Canada Life and design, and Canada Life Investment Management and design are trademarks of The Canada Life Assurance Company. Third party trademarks are used with permission or under license.