Reducing debt is the number one financial priority for the next 12 months but keeping on top of bills is close behind

Every new year brings concern about personal debt for Canadian households as the prospect of credit card bills post-holidays looms.

But for 2021, the intention to prioritize debt reduction comes as many families have seen reduced income in the past year, while the threat of unemployment is palpable; younger Canadians are particularly affected.

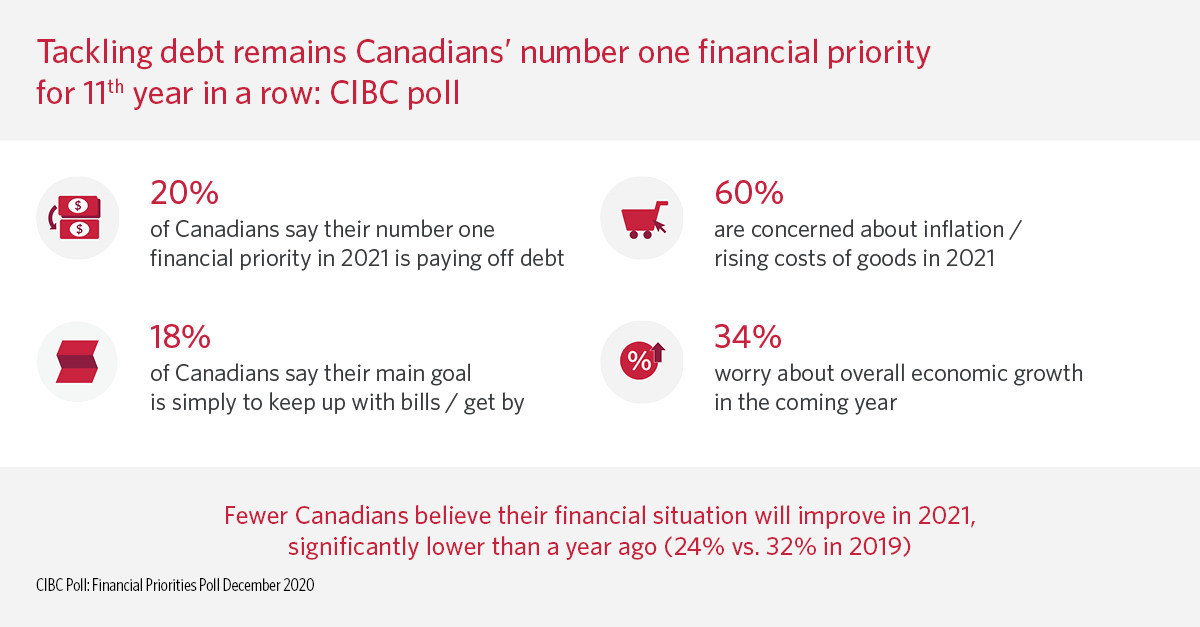

For the 11th consecutive year, paying down debt is the top financial priority (20%) of respondents to CIBC’s Financial Priorities Poll, closely followed by keeping up with bills/getting by (18%). The poll was conducted in December 2020.

The intentions may be constrained though by reality with less than one quarter or respondents expecting their finances to improve in 2021 (24% vs. 32% in the 2019 poll).

Canadians are increasingly concerned about the economy (78% said so compared to 55% a year earlier) with 60% expecting higher prices of goods and 34% worried about slower economic growth.

The uncertainty means that seven in ten respondents say it is difficult to plan ahead.

"Canadians have faced so many challenges [in 2020], it's understandable they are concerned about the economy in 2021. If this year has taught us anything, it's that we don't always know what's coming next and the best buffer for the unexpected is to be prepared with a plan and be open to adjusting it when circumstances change," said Carissa Lucreziano, Vice-President, CIBC Financial and Investment Advice.

Negative impact

Almost half of respondents said that their finances have been negatively impacted by the pandemic and a similar share says that it will take at least 12 months to get back on track.

This is in line with other surveys including one by TransUnion in December.

However, there was restraint in 2020 with 74% saying they held back on borrowing.

For those that did add to their debt burden, spending more than their income was the largest single cause (39%) followed by reduced income (27%).