The company has grown enormously in a short amount of time, and is poised to expand more into small retirement plans and wealth management

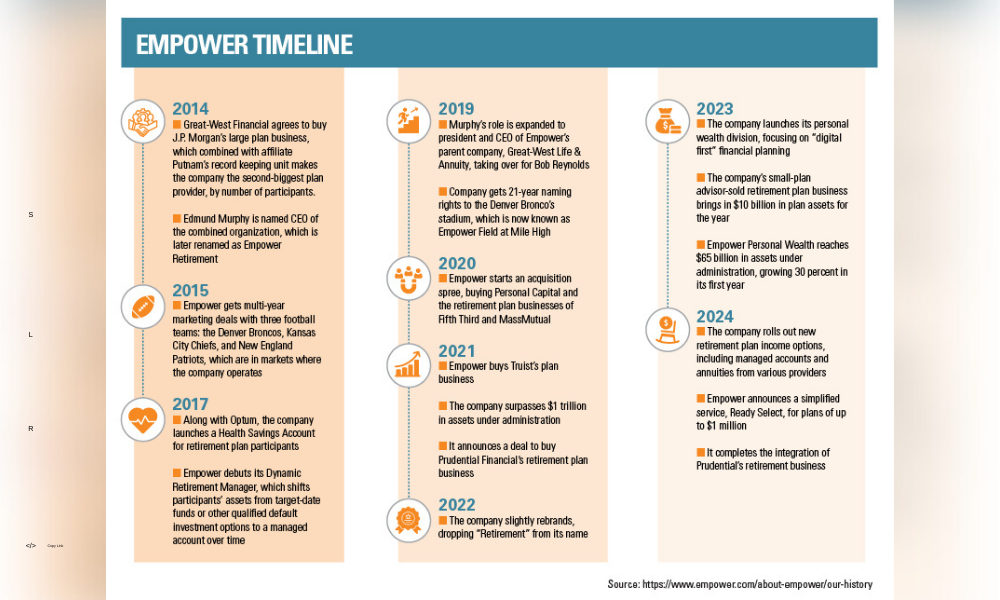

Last week, Empower wrapped up its integration of the $314 billion retirement plan business it bought from Prudential, capping an acquisition tear that it’s been on since the company formed a decade ago.

It might not be long before it makes another deal. The company, which two years ago dropped “Retirement” from its name, has been busy building up a wealth management business, and it has ambitions to expand in the small-401(k) business that many in the industry see as the next big area of growth.

“We’ll continue to be opportunistic where it makes sense,” said Edmund F. Murphy III, president and CEO of Empower.

Acquisitions that would significantly add to the company’s scale, give it new capabilities, and provide staff with expertise area ideal, he said, citing the 2020 deal to buy Personal Capital as an example that meets those criteria.

“Ideally if they can meet all three objectives, then that’s definitely the type of opportunity we’d like to pursue,” he said.

Empower, which is owned by Power Corp. of Canada, is a prime example of the consolidation happening in the retirement plan business. The company itself is the result of three businesses combining in 2014, as Great-West Financial merged its plan unit with that of then-affiliate Putnam Investments and the large plan operation of J.P. Morgan, which it had just acquired. As a result, it had more than $400 billion in assets under administration rocketed to being the second-biggest retirement plan provider by number of participants, at nearly 7 million, trailing Fidelity.

Since then, Empower has bought retirement plan businesses from Fifth Third, MassMutual, Truist, and Prudential. Across its retirement plan and wealth businesses, the company now administers about $1.6 trillion among 18.6 million people.

On the retirement plan side, more potential deals remain but are getting fewer and farther between, Murphy said.

“There continues to be opportunities in the workplace side of the business. The market is continuing to consolidate, to narrow… You’re going to continue to see subscale players continue to exit,” he said. “On the wealth side, there is a lot of consolidation occurring too.”

In both businesses, scale is a big issue, as costs to keep up with competitors on technology, customer service, and data security are high, he said. That is forcing smaller players to consider selling – there are as many as four retirement plan providers that are likely doing so right now, he said.

He envisions the company’s customer base reaching about 30 million people over the next five years, growing by winning more customers and through acquisitions, he said.

A small big deal

The small retirement plan market is a huge opportunity, as 15 to 20 million small businesses in the country don’t offer 401(k)s or other plans, he said. Many states are implementing automatic IRA systems that will require employers to participate or offer their own plans, and that has been driving business to the private market. In March, Empower announced a simplified service for startup and small retirement plans of up to $1 million, which it calls Ready Select.

As with its wider retirement plan business, Empower is selling that through advisors – it does not sell directly to plan sponsors.

“We’re selling that and offering that through the advisor community, because we don’t have the distribution and the bandwidth,” Murphy said.

Regulatory and legislative changes, notably the Secure 2.0 Act, will expand retirement plan coverage, as small businesses have more incentives for starting their own plans, said Viraaj Kumar, associate director at ISS Market Intelligence. There are various companies vying for that business, including Vestwell and Ubiquity, but one thing that benefits Empower is the tremendous size of its business, as well as the technology it has invested in, he said.

“When you have both, like Empower does, you’re really cooking with gas,” he said.

Wealth is still a new area for the firm – it last year launched its Empower Personal Wealth, rebranded from the Personal Capital name, which represented $76 billion as of the end of the first quarter of 2024 across about 600,000 accounts. Through Personal Capital, it extended financial-wellness services to retirement plan clients, though most of the 4 million registered users of its freemium personal wealth services are not from its plan business, Murphy said.

“Over time, many of those clients will choose to retain us and hire us,” he said, of the higher tiers of money-management services that are part of the business line.

Frenemies?

For years, there has been a convergence happening across retirement and wealth businesses, where 401(k) clients are seen as an opportunity for additional services.

That dynamic has some retirement plan advisors on edge.

“Fidelity, Schwab, Vanguard – they’re going after participants. The advisors don’t like it, but it’s pretty well known. [The companies] don’t try to hide it,” said Fred Barstein, founder of The Retirement Advisor University. “Empower is trying to play both sides. On the one hand they want to be known as advisor-friendly… On the other hand they’ve got Personal Capital which is now Empower Personal Wealth, and they are going after participants.”

Though Empower does plan business through outside advisors, the company has obviously been trying to boost its brand recognition among consumers, he noted. It has marketing deals with several NFL teams and professional golfers – and it has the naming rights to the Denver Broncos’ stadium, now called Empower Field at Mile High.

“They do want to be Fidelity – and they’re trying very hard to have a retail brand,” Barstein said. “They’re really focused on consumer marketing, not industry marketing.”

Those companies are not totally comparable – Empower, for example, does not have its own investment products, though it has collaborated with asset managers with which it has relationships. The company does not sell retirement plans direct to plan sponsors, and, unlike Fidelity, it has been active in mergers and acquisitions, Barstein noted. One of Empower’s superpowers is being able to do so many deals and efficiently integrate the businesses it has scooped up, he said.

“They don’t have a wealth distribution. Because they don’t have funds, they don’t have wholesalers going out to wealth advisors,” he said.

George Revoir, a consultant who was previously vice president of distribution at John Hancock Retirement, said it’s nothing new for big retirement plan providers to compete with advisors for the client.

“For years the advisors thought Fidelity was the evil empower and would always step in front of them to get rollovers,” he said. “You’re at as much risk right now with Empower as you are with Fidelity.”

The company’s growth has been phenomenal, and it continues to show a leading-edge mindset that it’s had since the beginning, he said.

But the company treads lightly when it comes to the advisors it works with, Murphy said.

“We would be challenged to meet the needs of all the participants on our platform,” he said. “We are increasingly working with advisor partners… In many cases we refer business to them.”

“It’s a big universe out there. Out strategy is to find ways to collaborate,” he said. “We’ve made a concerted effort to try to find common ground and recognize that we can’t be everything to all people.”

Although the company doesn’t have its own affiliated funds (Putnam Investments, which was also part of Empower parent Great-West Lifeco, was sold early this year to Franklin Templeton), it has relationships with numerous asset managers that get access to its sales teams – a strategy that others in the retirement plan market have emulated, Barstein said.

Empower includes about 75 asset managers’ products on its platform, and it has some sort of relationship with about 30 of them, Murphy said. Because the company’s market share is growing, asset managers want their products at Empower, he said.

“We can’t give 75 asset managers access to our sales teams… it would consume all of our time. There has to be a process around that,” he said. Empower’s internal team screens products, but plan advisors and plan sponsors are the ones who determine which ones are used within plans, he said.

“We’re a $3.5 billion revenue business – any fees we get from asset managers are inconsequential to the scale and breadth of our business,” he said. “We have hundreds of investments that are available on our platform. We are effectively Switzerland.”

Roll with it

In addition to adding wealth management clients, a widespread goal in the retirement plan provider business is to retain participants, either by keeping them in-plan after their leave jobs or retire, or through IRA rollovers.

The Department of Labor’s new fiduciary rule complicates the rollover business for some players, and that could force them to exit the market, potentially making them acquisition targets for Empower, said Dennis Gallant, associate director at ISS. Further, the company’s focus on financial wellness and wealth management gives it an advantage in building relationships with clients and retaining them, he said.

“Every firm is trying to provide that continuum of advice and [wealth] capability,” he said. “Empower’s got a lot of participants that feed into it’s [prospecting]. They’ve got the scale and the infrastructure to be competitive from a cost standpoint.”

In the company’s favor is that it uses “more of a fiduciary business model than the traditional folks,” said Lou Harvey, CEO of Dalbar. By compensating advisors for recommendations that are not tied to the investments themselves, it seems to have insulated the firm from the litigation that has roiled the 401(k) world, he said.

“What Empower has done is eliminate conflicts of interest,” he said.

While the company has supported much of the regulation and legislation that has made retirement saving more accessible to the public, it has had issues with the DOL’s new fiduciary rule, which will affect IRA rollover recommendations. The new rule is already facing legal challenges.

“If the rule’s enacted as, it is it would require some change around practices and disclosures, but not significant change,” Murphy said. “It’s likely that firms like us will have to comply well before the courts rule on this, which makes it a bit more challenging… [But] we’re pretty well positioned in putting the client first.”