Berkshire Hathaway announces “substantial exit” from Canadian lender

Shares in Canadian non-bank lender Home Capital fell by more than 12% Wednesday following the news that a Berkshire Hathaway subsidiary was pulling back from its investment.

Columbia Insurance Company is expected to end this week with a holding of less than 10%. It was a year and a half ago that the firm took a near-20% stake in Home to shore up the lender’s finances following a liquidity crisis.

Berkshire Hathaway loaned Home $2 billion and had an option to increase its investment in the firm to nearer 40% subject to shareholder approval. However, Home’s shareholders decided not to approve that larger holding.

Home is now buying back 18.2 million of its shares.

Cheering from the sidelines

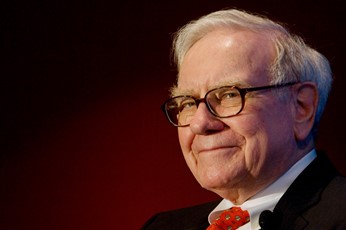

“Berkshire’s investment in Home is now not of a size to justify our ongoing involvement,” said Berkshire’s Warren Buffett. “Although we have decided to substantially exit from our investment, we will continue to cheer from the sidelines for our friends at Home.”

Home Capital’s president and CEO Yousry Bissada thanked Buffett and his company for their backing, saying it has allowed Home to position for long-term success.

“Following the successful completion of our Substantial Issuer Bid, Home Capital is in an excellent position to continue providing industry-leading service with a strong focus on sustainable risk management,” he said. “Berkshire’s investment in Home Capital provided substantive assistance to the Company and created stability and value for the Company and its stakeholders at a critical time in 2017. Since that time, Home Capital has returned to profitability, strengthened its business and made significant progress on its strategy for sustainable growth.