The divergence of the two fund groups continued in October according to new data from the Investment Funds Institute of Canada

Investors continued their exodus from Canadian mutual funds in October, while boosting their holdings in exchange-traded funds (ETFs).

New data from the Investment Funds Institute of Canada (IFIC) reveals net redemptions of $8 billion for mutual funds last month, following a $9 billion retreat in September.

Balanced funds accounted for $5.7 billion of the net redemptions, followed by equity ($1.9 billion), bond ($1.7 billion), and speciality ($2 million), offset slightly by sales of money market funds ($1.2 billion).

Total mutual fund assets gained $40 billion (2.3%) in the month to a total of $1.8 trillion.

Read more: Check out news about mutual funds

ETFs grow

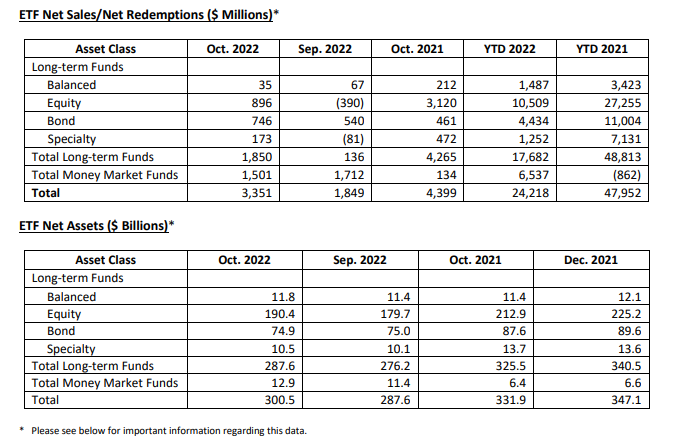

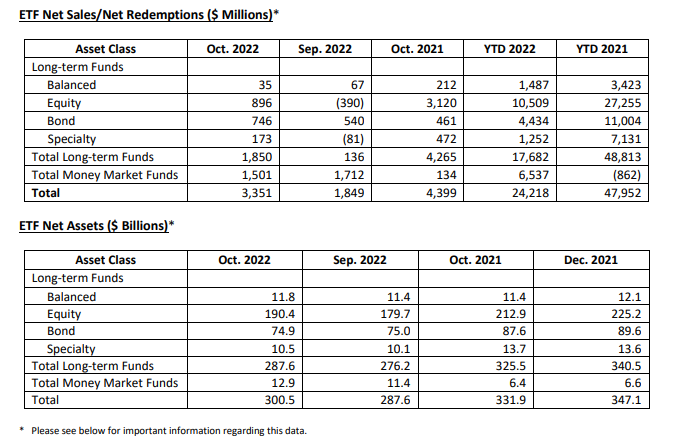

Meanwhile, Canadian ETFs continued to grow in both net sales and total assets.

Net sales were $3.4 billion for October, up from the $1.8 billion recorded in September.

This was driven by $1.5 billion in money market funds, $896 million for long-term equity funds, $746 million for bonds, and $173 million for speciality.

Total assets for the funds gained by almost $13 billion (4.5%) to more than $300 billion.

* Important Information Regarding Investment Fund Data:

1. Mutual fund data is adjusted to remove double counting arising from mutual funds that invest in other mutual funds.

2. Starting with January 2022 data, ETF data is adjusted to remove double counting arising from Canadian-listed ETFs that invest in units of

other Canadian-listed ETFs. Any references to IFIC ETF assets and sales figures prior to 2022 data should indicate that the data has not

been adjusted for ETF of ETF double counting.

3. The Balanced Funds category includes funds that invest directly in a mix of stocks and bonds or obtain exposure through investing in other

funds.

4. Mutual fund data reflects the investment activity of Canadian retail investors.

5. ETF data reflects the investment activity of Canadian retail and institutional investors.