Mercer Canada says equity drop coupled with falling bond yields is bad news

The market vulnerability caused by coronavirus fears is hitting Canada’s defined benefit pension plans.

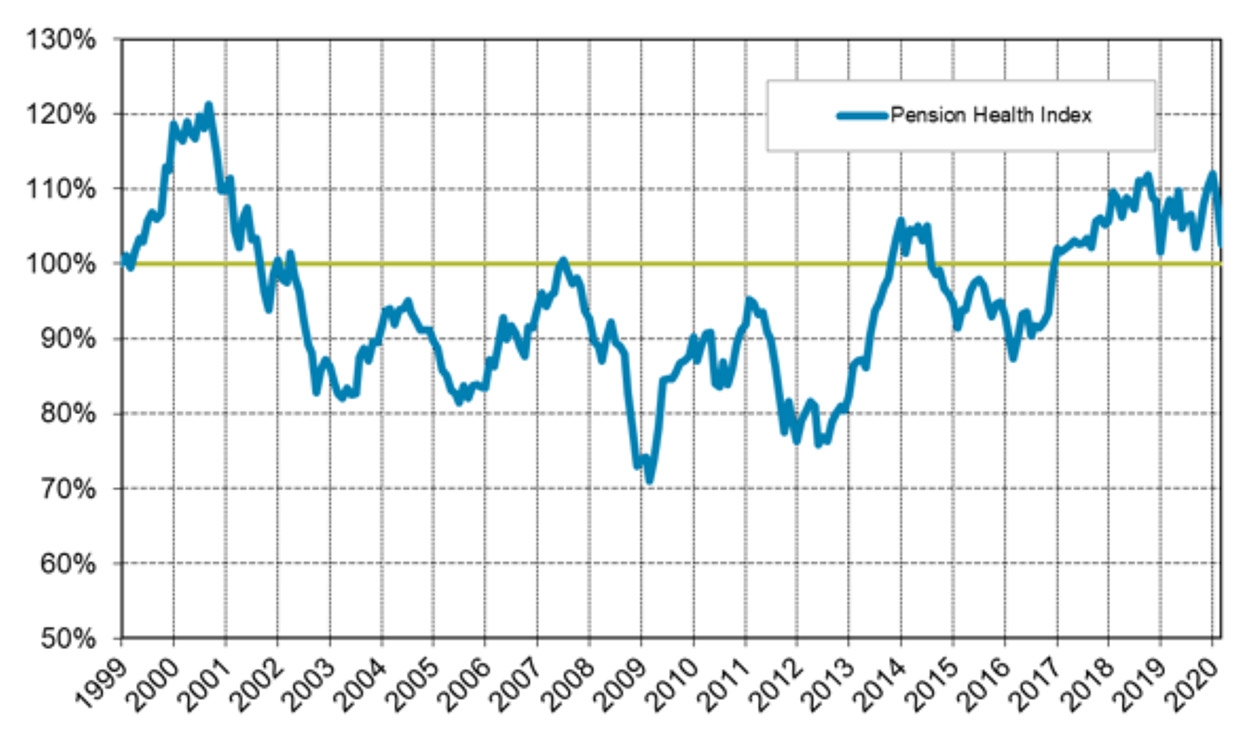

The Mercer Pension Health Index, which represents the solvency ratio of a hypothetical plan, dropped at the end of February to 103% from 112% at the end of 2019.

The stats on pension plans of Mercer clients show a decline in solvency ratio from 98% to 92% since the end of last year.

With investors opting for safe havens prompting a sell-off in equities; and a move to government bonds reducing long-term yields, pension plans are under pressure.

“The market reaction to the virus is a twofold blow to DB plans as the equity market decline erodes the assets and drops in bond yields directly increase the liabilities,” said Andrew Whale, Principal in Mercer Canada’s Financial Strategy Group.

Whale added that plans may not feel an immediate impact but should review both short- and long-term risk management strategies with the range of outcomes for plans having widened.

He suggests multiple approaches including diversifying growth portfolios, decreasing interest rate risk and seeking opportunities for risk transfer where appropriate.

While 2019’s strong returns from Canadian equities has provided a buffer for many DB pension plans, the safety net is reducing.

Impact for pensions

Mercer’s calculations show a 0.5% decline in a typical balanced pension portfolio in the first two months of 2020.

The S&P/TSX Composite Index returned -4.3%. All sectors posted negative returns with the exception of Information Technology, Utilities and Real Estate.

Meanwhile, Canadian fixed income markets rose amidst lower yields with long-term bonds (6%) outperforming universe bonds (3.6%). Real return bonds were up 5.2%.

The decline in returns from international equities was sharper with the MSCI EAFE returning -9.2% in local currency (-7.8% in CAD). The US equity market returned -8.3% in USD terms (-5% in CAD). Emerging markets also detracted value in both local currency (-7%) and Canadian dollar terms (-6.5%).

“The end of February saw global equity markets experience sharp sell-offs on growing coronavirus fears, and several equity markets entered correction territory” said Todd Nelson, Partner at Mercer Canada. “However, while markets could fall further, it’ll be nearly impossible for investors to catch the low, and the recent history of market corrections shows that recoveries can be rapid.”