FP Canada report measures Canadians' sense of financial wellness, and which diverse groups need more industry attention

A future Canadians from all walks of life have access to qualified professional financial advice, and have full confidence in their finances, is certainly a tough goal to envision for the far future, much less within the next 10 years. But that’s exactly what FP Canada is hoping to achieve.

“Back in 2020, FP Canada started doing work on what our Imagine 2030 vision would be,” says Tashia Batstone, President and CEO of FP Canada. “It was really about financial wellness for all Canadians. And focusing on the word ‘all’ we really tried to think through how we can serve Canadians from across the wealth spectrum, but also having a lens on diversity, equity and inclusion as part of it.”

As a blueprint for that agenda, FP Canada has published the first edition of its Imagine 2030 Benchmark Report, which shows how Canadians – including several specific sociodemographic groups – assess themselves on four indices that will be tracked on an annual basis:

- The Financial Well-Being Index, which measures whether respondents feel secure in their financial situation;

- The Financial Confidence Index, which focuses on whether respondents feel confident about financial matters;

- The Financial Access Index, which measures whether respondents feel professional financial help is accessible or out of reach for them; and

- The Financial Trust Index, which tracks whether respondents trust financial professionals or have concerns about working with them.

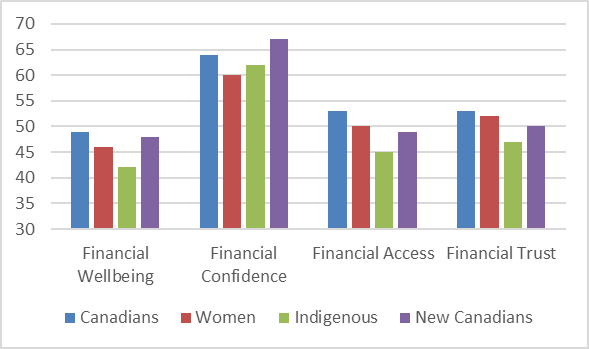

With a self-assessed score of 49 out of 100, Canadians showed a very marginal negative bias in their Financial Well-Being, but that was more than offset by their Financial Confidence (64 points). When it came to Financial Access and Financial Trust, Canadians’ scores showed a slight positive tilt (53 points for both indices).

“One of the things we saw was that the trust index has a really direct impact on the access to advice index. People have to feel that they can trust financial professionals to feel that they can access financial services,” Batstone says. “And the access index directly impacts both the well-being and confidence indices. It’s a domino effect.”

Tellingly, FP Canada found that every 10-point increase in the Financial Trust Index correlates to a six-point rise in the Financial Access Index. In addition, each 10-point increase in the access index correlates to a five-point increase in both the Well-being and the Confidence indices.

“The more we're able to foster trust in the financial planning profession, the more Canadians are going to feel that they can access the professional advice they need, which we know ultimately leads to stronger financial well-being,” Batstone says.

A deeper look at the data for specific groups of Canadians, suggests there’s still much progress to be made to achieve FP Canada’s vision for 2030.

For example, both women and Indigenous Canadians, scored lower than the broader Canadian population on all four indices. And while new Canadians scored above average when it came to financial confidence, they were below average on the other three indices.

“What all this data tells us is that there’s work to be done to make sure that professional advice is accessible to Canadians from diverse backgrounds,” Batstone says. “If we really want to help more Canadians, we really have to understand the barriers that are holding them back. … This research is really going to ground a lot of our efforts to understand what these factors are.”

Teasing apart the statistical threads is certainly a challenge. Some issues can be rooted in a lack of financial literacy, or a deep-seated discomfort in dealing with financial professionals. The current state of the economy and financial markets could also be casting an external shadow on Canadians’ sense of financial well-being. In some cases, people might be feeling a false sense of financial confidence.

A look at some of the survey questions also points to a need for greater diversity in the financial advice industry. When presented with the statement “financial professionals often look a lot like me,” only 27% of respondents overall agreed. Responses to statements like “it is hard for people like me to find good financial advice” and “it’s hard to find a financial professional who understands my culture and background” also highlight a lack of representation in the industry.

“We’re in the process of finalizing a new strategic plan, which has been heavily influenced by some of this research,” Batstone says. “To create a more diverse profile of FP certificants, for example, we’re talking to post-secondary institutions to encourage more people to take on a career in financial planning, for example. And among our existing professionals, there are conversations to be had about how to deal with more diverse research.”

Beyond that, FP Canada is reviewing its education programs to ensure there are no unintended barriers to inhibit someone from becoming a financial professional in Canada. For instance, it recently relaxed its CFP professional requirements to include anyone who’s worked for three years in the financial advice industry, whether they had that experience within the country or internationally.

“The reality of it is change takes time, and this is going to require a coordinated effort,” Batstone says, noting that FP Canada is also having discussions with firms and other organizations across the industry. “There are definitely steps that we're taking and will continue to build upon over the next eight years. But eight years will go by in a blink, so we need to be very proactive and start engaging now.”