Vanguard predicts impact of a structural shift in rates will provide a foundation for returns

Vanguard’s economic and market outlook for 2024 acknowledges the pain rate hikes have caused investors over the past 18 months but claims that “sound money,” which they define as positive real interest rates, will persist. Higher rates represent a new structural shift, the outlook says, which will endure beyond the next business cycle and present a “solid foundation for long-term risk-adjusted returns.”

The overall forecast points to a greater balance in returns for investors, compared to the equity-driven growth of the past decade. Sound money, they claim, sets the stage for better fixed income returns. At the same time, the equity market has not yet fully priced in the implications of persistent sound money.

“Higher interest rates are here to stay,” the report reads. “Even after policy rates recede from their cyclical peaks, in the decade ahead rates will settle at a higher level than we’ve grown accustomed to since the 2008 global financial crisis (GFC).”

This ‘higher for longer’ thesis implies that borrowing and savings behaviour will change globally, with capital allocated more carefully and returns expectations reset. Vanguard believes that the transition to this environment will be “bumpy” but serve investors well in the long-term.

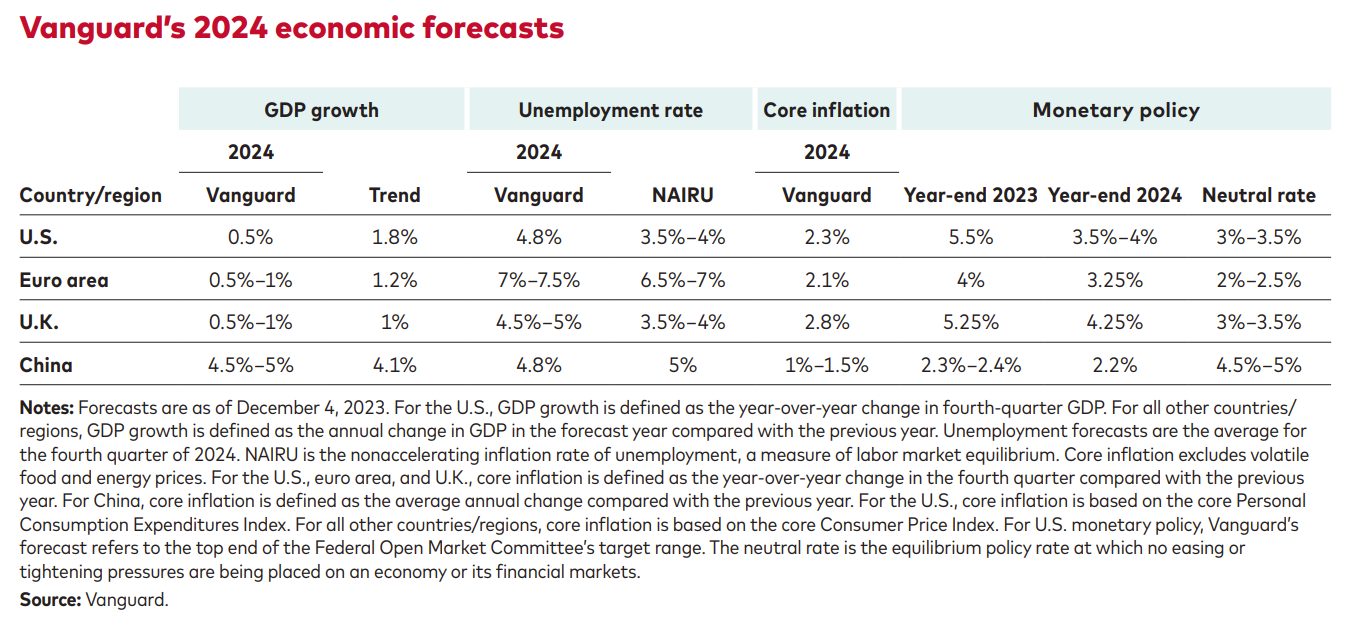

One of the noted trends from this year was the US beating recessionary expectations. Vanguard notes that as the exception to an otherwise significant slowdown in developed economies. They expect, as well, that the US will cease to outperform with exception in 2024. European growth is forecast as ‘anemic’ and Chinese growth is largely contingent on further stimulus.

The outlook from Vanguard is bullish on bonds. They predict US bonds to return a nominal annualized 4.8%-5.8% over the next ten years. International bonds are forecast to return 4.7%-5.7% annualized. That is compared with 1.5%-2.5% returns in the US and 1.3%-2.3% global returns when rates were low or negative in past years.

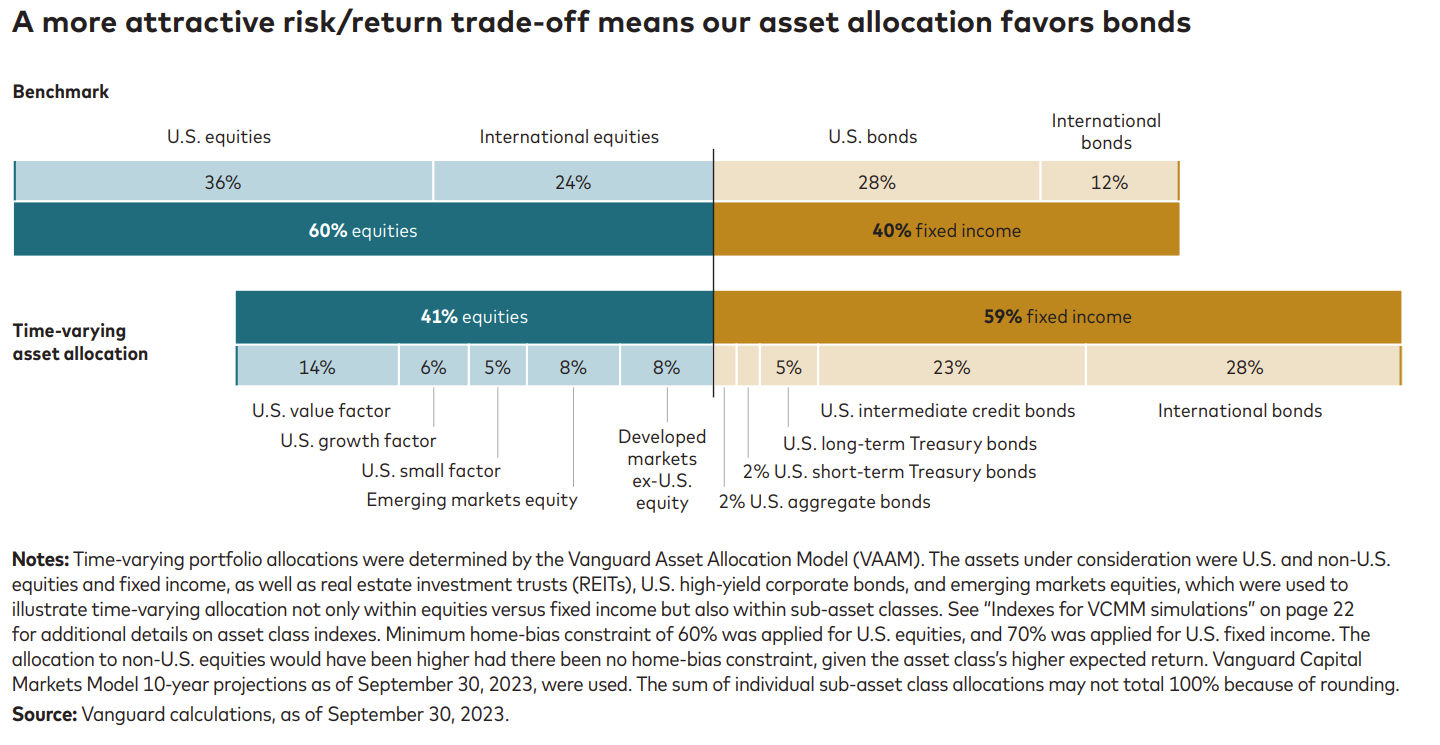

While bond investors lost capital in the past two years, Vanguard argues that if the income component of bond returns is reinvested at this rate level returns will “more than offset” those losses. As bonds have become more attractive Vanguard argues that the case for a traditional 60/40 portfolio is now stronger.

Vanguard predicts rate cuts in 2024, resulting from economic slowdowns, but expects we will not return to the zero-rate era of the past decade. They forecast that Canada will be the first developed economy to cut rates next year and will make the steepest cuts compared to the UK, Australia, the US, and the Eurozone.

Rates are forecast to stay relatively higher than they did post-GFC, however, because of aging populations and structurally higher government deficits. As people age, they will shift from saving to spending. Governments, as well, will need to borrow more to finance necessary operations. That results in more borrowing and less saving, pushing up the cost of money.

Vanguard’s outlook has resulted in a significant tilt towards bonds in their valuation-aware time-varying asset allocation (TVAA) which is designed for investors comfortable with model forecast risk. That portfolio is modeling a shift to 41% equities and 59% fixed income — compared to its 60/40 benchmark.