Ground-breaking research looked at spillovers of precious metals commodities and equity markets across continents

Positioning portfolios to mitigate risk in financial markets often includes precious metals commodities but are your clients choosing the right ones?

An international study aims to help investors protect their portfolios during financial volatility.

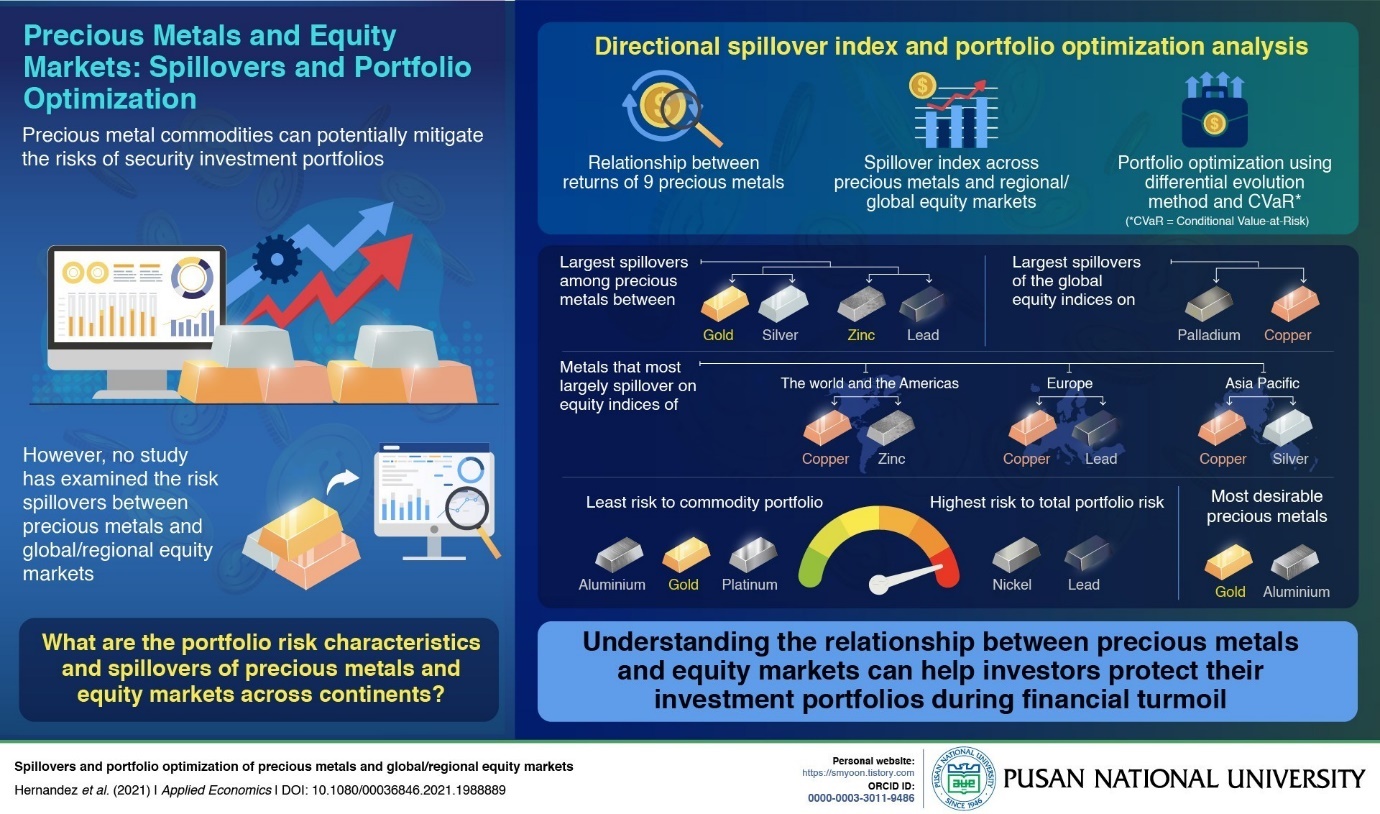

Economists from Rennes School of Business, France, and Pusan National University, Korea, analyzed the spillovers and resource allocation characteristics of nine precious metals - gold, silver, palladium, platinum, nickel, lead, zinc, copper, and aluminum - and global/regional equity markets, which was previously unexplored.

"What precious metal commodities most largely spillover on the equity indices? What precious metals add the most/least risk to my portfolio? What precious metals are most desirable for investment? These are the closely linked questions we wanted to explore in this study," said Pusan’s Dr. Seong-Min Yoon, speaking of his motivation behind the study.

The research found that when portfolios were optimized using a differential evaluation method, the largest spillovers occur between gold and silver and between zinc and lead, while the largest spillovers of the world, the Americas, Europe, and Asia Pacific equity indices are on palladium and copper.

Nickel and lead add the highest risk to total portfolio risk, while platinum, gold and aluminum add the least risk to the portfolio of commodities. Meanwhile, the most desirable metals for investment were found to be gold and aluminum.