As advisors increasingly turn to alternative investments to reduce risk and generate returns amid market volatility, WPC examines seven of the most popular alternative strategies out there

The end of 2018 saw the return of volatility to the equity markets, and with it, a rise in advisor interest in including alternative investments in portfolios. There are numerous ways that these strategies can be implemented, all with the goal of mitigating risk, dampening volatility and finding returns during down times.

As the market experienced its long bull run, the need to look at alternatives was less of a priority for both advisors and investors. However, now that a global economic slowdown has appeared on the horizon, alternatives strategies will become even more important as a way to preserve wealth.

On the following pages, WPC takes a look at some of the many alternative investment options, highlighting their benefits and risks. From hedge funds to commodities such as oil and gold to private investments in equity and real estate, there are many ways to diversify portfolios with alternatives.

We partner with advisors and the investors they work with by bringing them innovative investment solutions, excellent asset management and superb service. Our team delivers innovation and expertise through mutual funds, ETFs, alternative investments, private wealth pools and managed solutions. We also offer a charitable giving program and solutions for saving for a child’s education and giving financial assistance to people with disabilities. We strive to bring insights, data and tools to advisors to help them support their clients. For more information, visit mackenzieinvestments.com.

HEDGE FUNDS

Headed for a spike in popularity?

Advisors are taking a new look at hedge funds as a way to reduce risk, which could make them increasingly desirable in 2019

Over the past few years, hedge funds have failed to produce the returns investors have been looking for. Driven by the perception that equity markets have only been on the rise for the past 10 years, many investors have focused on gaining returns from straight equity exposure, avoiding the seemingly less fruitful, yet also less risky, strategies offered by hedge funds.

However, when the equity markets experienced a meaningful pullback in the final quarter of 2018, hedge funds once again proved their worth. Now, with volatility apparently here to stay, hedge strategies could see renewed popularity.

“If volatility is going to continue, as we think it will, having hedge in portfolios does make sense,” says Paul McKenna, an investment advisor at Richardson GMP. “I use it to mitigate risk, dampen volatility and smooth out returns in my clients’ portfolios.”

McKenna, whose many years of experience in this area include a stint as part owner of a hedge fund company, recognizes that investors who used hedge funds over the past few years might have felt they detracted value. However, that all changed late in 2018.

If you simply bought the S&P 500 and rode it, you would have been further ahead,” McKenna says. “Then the last quarter of 2018 hit, and you recognize that having a little protection might be a good thing.”

There is a trade-off with hedge strategies:

As markets trend upward, investors might forfeit some of the gains at the higher end, but when volatility spikes, hedge funds can better mitigate risk and losses. Studies show that investors fear losses more than they enjoy gains, so this trade-off tends to be appealing to high-net-worth investors who have made their money and want to keep it.

McKenna believes the recent uneven performance of hedge funds can be attributed to heightened uncertainty and unpredictability in the markets. “As the market bounces around for unexpected reasons – most notably frequent and random tweets from the White House – it makes it harder even for more sophisticated hedge strategies to anticipate what is going to happen and to implement successfully,” he says.

Despite those factors, McKenna feels the current landscape will lead more investors back to hedge funds. “At Richardson GMP, we are leaders in the hedge space, so we are seeing more people in hedge strategies,” he says. “Leading up to the quarter we just had, people had become complacent towards volatility. My team has seen a huge move towards index ETFs; however, after what they witnessed recently, investors might not like that ride. I think you’ll see more people return to hedge funds. It is a form of active management, and I think you’ll see more of that going forward.”

Even though 2019 has started strong, McKenna sees the bounce-back in the market slowing down, opening the door for active hedge managers to demonstrate their value. He believes managers will return to focusing on holding companies with solid fundamentals and shorting those without.

McKenna identifies a number of hedge fund strategies advisors might want to consider. One common strategy is market neutral, which aims to be equally long and short in the market – and sometimes even each sector – at all times. This largely removes the broader moves of the markets (the beta) and focuses on the stock-picking ability of the manager (the alpha). Theoretically, this means the strategy can make money in up or down markets. However, when equity markets rise sharply, the strategy doesn’t work as well, as the shorts will always be a drag on performance.

In a long/short strategy, managers go long on the companies they like and short a handful of the ones they don’t. This strategy seeks to earn profits from strong companies while using the shorts to either hedge the long portfolio or seek gains on weak companies.

In global macro strategies, managers take a top-down approach to identify areas around the world that offer the most attractive opportunities to invest, then dig deeper to find the sectors or companies in those areas that offer the greatest opportunity to employ their hedge strategies.

Finally, merger arbitrage is a lower-risk/ lower-return strategy that looks at pending corporate deals, taking a position on how the deal will play out as the close date approaches.

While each strategy is different, they all attempt to generate returns that don’t simply rely on the market going up, which can lower portfolio volatility when compared to the broader markets.

“Hedge is meant to hedge away risk,” McKenna says. “A lot of people think of hedge as risky, but if used properly, it should allow you to lower volatility in a portfolio. Over a longer timeframe, this can help achieve the goal of outpacing the market.”

The risk with hedge funds, especially those using a long/short strategy, is that a manager could be wrong on both sides. However, McKenna says the bigger risk is that if investors don’t understand the strategy, they might think it’s underperforming and want to deviate.

“They forget that it’s meant to be doing its own thing, showing its value in different ways than simply following the everyday up-anddown market movements,” he says. “In volatile periods, clients appreciate having those strategies in their portfolios. Without getting too technical, it’s important for advisors to have clients understand why it’s in the portfolio.”

PRIVATE EQUITY

The key to repositioning portfolios

Private equity can provide certain investors an attractive shelter from market volatility

As investors search for alternative ways to reposition their portfolios, many have begun to turn to private equity.

“We are seeing the proliferation of private equity funds,” says Peter Kinkaide, CEO of Raintree. “There is more capital being set aside to invest in the private equity industry, which is indicative of what investors globally are looking for – higher risk-adjusted returns.”

While it can be tough to evaluate recent performance because private equities don’t have day-to-day trading data like their publicly traded counterparts, Kinkaide says investors have been drawn to the space by recent public-market volatility.

“What we are hearing from advisors is clients calling them looking to reposition their portfolios as a function of that volatility,” he says. “There is definitely stronger demand for investments that aren’t linked to the market, especially when the market is volatile.”

Kinkaide adds that investors have been drawn to private equity by expectations of returns north of 10%. Some funds distribute dividends along the way, while others generate returns on capital and profit when the private equity fund exits the investment.

“At its very basic notion, you can purchase a business for a multiple of earnings that you can’t find in the public markets,” Kinkaide says. “What that does is it gives you the opportunity to make a better return. If all other things are equal, and you have a business that trades on the public market at 20 times and you can buy it at six to eight times in the private market, you are generally better off purchasing it for less.”

As with any investment, the higher returns in private equities come with greater risk; Kinkaide highlights illiquidity and less information about the investment as the major ones. “What are you exchanging is the ability to trade those securities,” he says. “If you don’t like those securities, it’s difficult to bail out. There tend to be trade restrictions or restrictions against redemption. Another key risk is that reporting standards are significantly lower than a public company. You won’t receive as much information about the investment over time.”

At Raintree, Kinkaide and his team have zeroed in on the right investments by looking for opportunities where the team has expertise. Current areas of focus include industrial services and a dental rollup strategy, which he believes will be more resilient if and when another recession hits. He notes that the amount of capital in the private equity space has made it very competitive, so having that specialization is what sets his firm apart.'

While Kinkaide believes private equity can complement most portfolios, he cautions that it’s not right for everyone.

“You have to have a risk tolerance that comes in line with purchasing higher-risk securities,” he says. “You also have to have a timeframe for the capital you are deploying that matches the illiquidity of the investment. It is really important for investors to talk to their financial advisor to see if it is a good option for them.”

GOLD

The gold standard of protection

With an inverse correlation to the market, gold can provide the insurance portfolios need during times of turmoil

When the bull market was raging on, investors paid very little attention to gold, but the pullback in the fall sparked renewed interest in the precious metal. Given its longstanding history of wealth preservation and its inverse correlation to the market, gold could see even more interest in the near future.

“The last couple years have been tough for gold because the S&P 500 and NASDAQ have outperformed it and interest rates have been going up, which can affect gold’s performance,” says David Harquail, CEO of Franco-Nevada and chairman of the World Gold Council. “Now, in the last quarter, the momentum has come out of some of those markets, and the prospects for interest rate increases have subsided. You are starting to see more interest from institutional and retail investors in gold.”

While the bull market made things difficult for gold, Harquail points out that the commodity has actually remained fairly stable at around $1,200 to $1,300 an ounce.

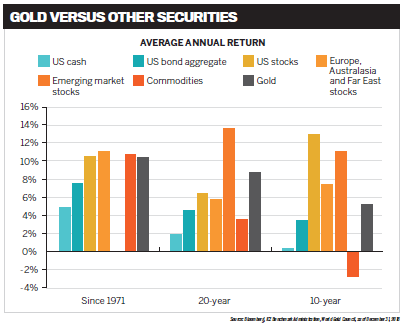

“Gold itself has performed OK,” he says. “If you look in terms of annual returns, it has been competitive with other asset classes. Those who are negative towards it point to how awful it has been since its peak in 2013, but if you look at longer-term trends, it has performed well.”

While gold can have a long-term risk of underperforming against the markets, Harquail is optimistic for its outlook in the near future. He believes the current market volatility will drive more money into gold, especially as physical demand continues to grow in places like India and China.

“In terms of physical demand, the retail side is good,” he says. “The investment side will always be cyclical and a function of when people feel they need gold. When the markets – equity or bond – are hot, investors forget about gold because they want to make money elsewhere. Gold is a powerful thing to have in your portfolio because it’s one of the few assets that has an inverse correlation to the market.”

Harquail says another one of gold’s key distinguishers is the variety of ways investors can own it: physical gold, exchange-traded products, gold operating companies, or royalty and streaming companies. He notes that while those who invested in gold stocks or mining companies have had a tough time, those who invested in the royalty and streaming companies have done all right.

“If you bought into the royalty and streaming sector, they have outperformed the gold price, paid dividends and been a growth area in the sector,” he says.

That’s largely because royalty and streaming companies such as Franco-Nevada aim to provide access to gold with less risk by offering a more diverse reflection of the sector.

“We don’t have the challenges of an operating company,” Harquail says. “We don’t have the risks if there is a capital overrun, inflation, tax changes or a major operations breach. We just take a percentage of the gold that comes from a mining operation. The advantage is we can be more diversified. I have 372 properties, including over 50 gold mines, in my portfolio. We can reflect the entire industry without the risk of an individual country or site.”

And, Harquail adds, gold has the benefit of not being tied to any particular currency. “If you are worried about what might happen with global debt, the US dollar, currencies or international trade relations and you want to preserve capital,” he says, “gold is the ultimate risk-off investment because it isn’t anyone else’s IOU.”

Add to that its inverse correlation with the market, and gold’s appeal increases. “I think everyone should have a bit of gold in their portfolio as an insurance component,” Harquail says. “There is a cost to having it there, just like insurance, and no one needs it until the storms, floods and hurricanes come. But when they do, it becomes valuable.”

PRIVATE DEBT

Finding consistent returns

Private debt can offer the benefit of stable returns – if advisors are willing to do their homework.

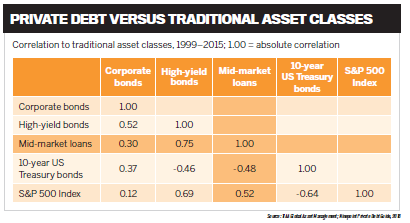

One alternative investment that has consistently offered steady returns is private debt. According to Wayne Ehgoetz, president and CEO of Waygar Capital, private debt can be a fruitful sector as long as investors and advisors understand what they’re investing in and who they’re investing with.

“I think private debt vis-à-vis the benchmarks has done well,” says Ehgoetz, who also serves as subadvisor for the Ninepoint Canadian Senior Debt Fund. “There aren’t a lot of us in the space, and the returns for the various funds have been quite good. Private debt has had a very consistent and reasonable return over the last number of years, including last year. So for investors, there has been that level of consistency.”

The private debt market isn’t as developed in Canada as it is in the US, in part because of regulation and the smaller population, which presents Waygar and other alternative lenders with great opportunity. When companies are rejected by the major banks, they turn to this relatively small cohort of lenders, allowing them to create more investment opportunities.

“I think we should see an increase in alternative lenders in this space,” Ehgoetz says. “What it will take for entrants is capital. That is probably the easiest thing. The difficulty will be finding the people who understand and have experience in the space.”

If advisors can pinpoint the right opportunities, Ehgoetz says there are great benefits. “From my perspective, the returns have been very good,” he says. “Private debt tends to do well in good and bad times. In good times, private debt lenders are lending to companies that are growing, maybe doing acquisitions and building their business. In bad times, it can help companies that are having some difficulties. A recession doesn’t mean the fund returns will diminish, which creates some comfort for investors.”

Of course, there are risks investors need to be aware of; in private debt, the main one is whether the lender is fully, partially or not secured by collateral – fully collateralized private debt is less risky.

“We are a private debt lender that requires all loans be supported by collateral, fully collateralized,” Ehgoetz says. “We assess the company and the collateral in terms of if it were to fail and we liquidated the collateral, would we get our money out for investors? If the answer is no, then we won’t do the loan. You do have other lenders that are not fully collateralized that may do loans based on cash flow. The risks will be higher, because when a business has problems and relies on cash flow, you may lose money.”

Moving forward, Ehgoetz believes there will be a good market for private debt, driven by the strengthening Canadian dollar and more stringent credit requirements at the major banks.

“That will tighten the market,” he says. “We are a big supporter of lending to sectors that banks don’t, such as military and security.

"We see a terrific market where there will be demand for private debt funds and an environment where Canadian banks won’t be able to respond to the demands.”

For advisors and investors, Ehgoetz emphasizes the importance of knowing the investment and the companies that are being funded.

“The fundamental core of our fund at Ninepoint is that any company we lend to has to have extremely strong management and collateral,” he says. “Entering into investments in companies that have those, you should be relatively comfortable that your risk is low. If your risk is low, your returns will be strong. The returns in this sector can be double-digit, consistently.”

LIQUID ALTERNATIVES

More than just a buzzword

New regulations that went into effect in January could usher more liquid alternative options for retail investors into the marketplace

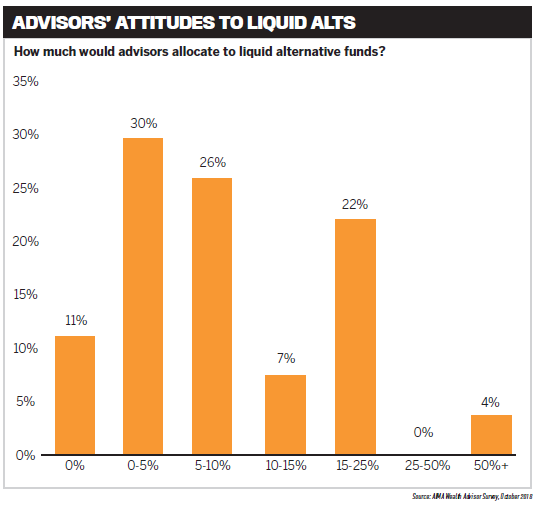

Liquid alternatives – officially known as alternative mutual funds – are mutual funds that have adopted fundamental investment objectives that permit the fund to invest in physical commodities or specified derivatives. They can borrow cash or engage in short-selling in a manner not permitted for other mutual funds. At the beginning of 2019, new regulations concerning liquid alternatives took effect, opening up the domain to retail investors.

“The CSA has amended National Instrument 81-102 to allow for hedge funds to be launched in a mutual fund format,” explains Claire Van Wyk-Allan, director of the Alternative Investment Management Association Canada [AIMA]. “There are constraints on leverage and shorting and a host of other options, but essentially it is like a hedgefund- lite product that will now be available by prospectus. It can be launched as mutual fund, ETF or closed-end fund.”

Liquid alternatives have been a hot trend worldwide; early estimates project the sector could reach anywhere between $20 billion and $100 billion in AUM in the next five years.

“I will probably temper those expectations. I think we will see cautious growth and adoption because there are a few bottlenecks to distribution in this space,” Van Wyk-Allan says, pointing to the amount of competition in the retail channel and challenges with product approval and risk classification. However, she adds, “it is incredibly exciting because it is bringing innovation to the Canadian marketplace.”

According to Van Wyk-Allan, liquid alternatives offer numerous benefits: diversification, risk reduction, volatility reduction and non-correlated returns. “If you look at, say, a 10% or 20% allocation to alternative investments in a balanced portfolio, the end result is you will dampen volatility through large market events, up and down. We want to take away that large volatility exposure, especially on the equity side, by adding these investments. If you look at bond exposure in portfolios, hedge fund managers can actually neutralize a rising rate environment by shorting equivalent government Canadian bonds.”

While critics of liquid alts have highlighted their higher fees and potential to suffer losses in a downturn, Van Wyk-Allan says risks should be evaluated within the context of specific investments – an area where the AIMA is working to help educate advisors and investors.

“You need to understand the manager who is managing the money and what their experience is,” she says. “What is the risk culture like at their firm? You need to understand how trading decisions are made, monitor for style drifts and really understand the strategy.”

Despite the distribution challenges, boutique managers have begun to launch more liquid alt funds. “Even asset managers who only played in the mutual fund or ETF space are launching alternative mutual funds to dip their toe in the hedge fund world,” Van Wyk-Allan says. “I do think it will have a huge impact on the way our investment industry is run. It is very important that Canadian investors ask about these types of strategies and the benefits for their portfolios to better preserve their wealth for the future.”

REAL ESTATE

Rethinking the old standby

Real estate has long been a staple of alternative investing, but new trends are reshaping its potential

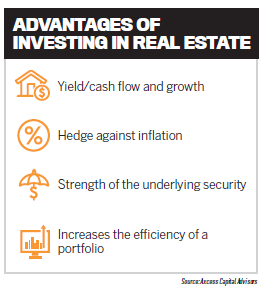

While some alternative investment strategies can confuse investors, the concept of investing in real estate tends to be easier for clients to grasp. Real estate investing has proven to be a consistent source of returns, and now that private options are opening up to more investors, many advisors are looking to differentiate their strategies by adding real estate to portfolios.

Axcess works with companies that have significant experience in the space and have shown consistent net asset value [NAV] performance of over 11%. “That’s what draws people to real estate,” he says. “They are looking for diversification, something that is not correlated to the public market and also that performance.”

One trend Jarman has noticed recently is Canadian investment dollars going towards US properties, which he feels is being driven by better values and new opportunities in the US. “Because of the tax relaxation and economic growth increasing in specific urban centres, it is a great time to invest in US properties,” he says.

Axcess’ strategy is to look for the best in class in a variety of real estate sectors to protect capital and find the most consistent returns for investors. Jarman notes that returns in the areas his team invest in have been in the 9% to 12% range.

“The higher yields are coming out of our mortgage investment corporations across Canada,” he says. “If you are looking for combined [yield and NAV], it would be in private REITs, due to the asset pool being valued by appraisal, not market.”

While conserving capital and consistent returns are the major benefits of real estate investing, Jarman adds that smart decisions in the space can pay off as well. “Smart acquisitions derive value off that asset, which is likely to appreciate in its market segment,” he says. “That is one of the main things we look for.”

As for the risks advisors and investors need to be aware of, “I think the most significant risk in the space would be illiquidity if there is a significant market change,” Jarman says. “One of the issues is that your commercial or residential property may have vacancy, and that will affect yield.”

In addition, he emphasizes the importance of having a good manager – a manager who hops around with an active and reactive strategy can be a red flag. “Look for managers with significant experience and make sure there is ongoing due diligence with that manager and team,” he advises. “Make sure they are following the original mandate.”

Moving forward, Jarman believes real estate will continue to draw investment as the public markets remain volatile. “I think the sophisticated money is looking towards alternatives,” he says. “If you target your mandate at middle-class rentals, where most income earners can pay rent, you almost have an annuity-like performance. There is a considerable need in the rental space, so outlooks are pretty strong.”

COMMODITIES

Beyond the doom and gloom

Opportunities still exist in oil and energy – if investors are willing to look past recent headlines.

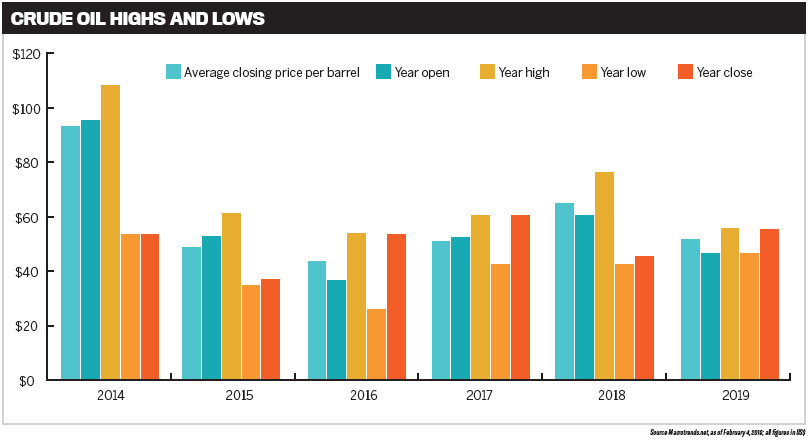

When it comes to the energy sector, it’s easy to focus on the negatives. The price of commodities fluctuates based on supply and demand, and the oil industry specifically has taken a hit recently. Oil isn’t correlated to the public market, and issues like oversupply have made oil a frustrating industry for investors in recent years.

Investors have typically been involved in the oil industry indirectly, by buying stock in oil companies or ETFs with holdings of multiple companies. However, direct investing through the purchase of oil futures or oil futures options is another way investors can gain access to the sector. In addition, new developments in ETFs such as partnership units in the US Oil Fund (USO), which holds near-month New York Mercantile Exchange futures contracts on WTI crude oil, or the Canadian Crude Oil Index ETF (CCX) have helped increase direct access to the commodity.

Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners, hasn’t given up on the energy sector yet. With investor interest at an all-time low, he believes there’s never been a better time to get involved.

“The narrative coming [into 2018] was overwhelmingly positive,” he says. “We had a continuation of inventory drawdown, producers in the US underspending or spending within their cash flow, countries within OPEC that were in decline and no real signs of economic decline. You had signals that general interest was coming back to the sector.”

However, that positive sentiment quickly changed. Overproduction from Saudi Arabia, intended to counter threatened sanctions against Iran, resulted in the market going from undersupply to oversupply in a matter of months. Oil crashed to an unsustainable level, and despite a rally early in 2019, the lack of investors in the space has kept oil trading below other commodities.

“There has been a growing trend of people questioning the investability of the energy sector,” Nuttall says. “With the past four or five years having negative double-digit returns, the sector has become incredibly volatile and complicated.”

Nuttall points to factors such as US policy towards Iran and now Venezuela, changes in OPEC’s views on stabilizing oil prices, and a focus on the future of oil versus electric energy, all of which have contributed to the mispricing in the sector. Today, he says, there’s little to distinguish between highand low-quality companies – something that should be an advantage for active money managers.

For the global energy industry to get back on track, Nuttall believes three things need to happen. First, oil prices need to stabilize at approximately US$55 a barrel. Second, the US-China trade discussions need to see some positive developments, which Nuttall believes will go a long way. Finally, oil & gas companies need to rethink their business models.

“For too long, the sector overspent cash flow, chasing growth at the sacrifice of maximizing returns,” Nuttall says. “This year, what you are seeing is companies saying they will be disciplined in using a low oil price in their budgeting. In 2019, any excess cash flow won’t go back into the ground, but rather to shareholder returns with buyback and dividends. If people see that this year, it will significantly improve sentiment towards the sector.”

Despite the negative feelings about the oil industry, Nuttall does see benefits for investors. “What excites me is the extreme level of apathy towards the energy sector,” he says. “I think we are in a $60-a-barrel- plus world going forward. If the level of disinterest in the sector continues, then companies will increase their level of share buybacks. I know there is a buyer at the end of the day for the stock – if it’s not investors, it’s the companies themselves.”

The major risk Nuttall sees for oil is demand, not supply. “I think the biggest risk is a worry on demand growth,” he says. “If we do go into a global recession and demand growth lessens below 1 million barrels per day, then you do have a loosening and are at the whim of OPEC to see if they would further constrain production to balance the market.”

While the health of the global economy concerns Nuttall, one development that could benefit Canada is the current political tension in Venezuela, which he believes could create opportunity for Canadian oil to replace its Venezuelan counterpart at US refineries.

Nuttall’s biggest message to advisors and investors is to look past the short-term noise in the sector. He says that if oil prices can get between $55 and $60 a barrel, opportunities can be found at a discount because of the overall disinterest in the sector.

“It could be an opportunity of a lifetime,” he says, “even with the acknowledgement that it has been a frustrating place to be invested in over the past five years.”