Royal Bank stocks are on a roll after experiencing lows from the last fiscal year. Is it a good idea to buy now or should you wait? Read on and find out

Royal Bank of Canada (RBC) stands atop of its peers as the country’s biggest bank. It also ranks among the biggest in the world in terms of market capitalization. And with its acquisition of another banking giant – HSBC – finalized, Royal Bank is poised to become head and shoulders above its Big Six cohort.

Now that the deal’s done, investors are asking, how will the purchase of Canada’s seventh-largest banking institution impact Royal Bank stocks? Have RBC stocks become overvalued? Wealth Professional Canada answers these questions and more in this guide.

How are Royal Bank stocks performing?

To get a clear picture of how Royal Bank stocks are performing, we’ll need to first look at its most recent earnings report.

In its 2023 full-year report, the banking giant revealed that net income reached $14.9 billion. The figure was down 6% from the previous year, with earnings per share dipping 5% as well. Despite this, Royal Bank has beaten out earnings estimates set by analysts, unlike many of its competitors.

The results also showed an increase in total provisions for credit losses of $2 billion compared to a year ago. The amount was intended to cover the losses in the personal and commercial banking, and capital markets segments.

While these losses were tough to swallow, Royal Bank did benefit from lower taxes and growth in some of its loan and wealth management units. The bank also stated that these provisions represented a steady rise from pandemic lows.

The banking giant, however, saw pre-provision pretax earnings hit $20.9 billion, a 2% jump from the previous year. The firm attributed the rise to higher net interest income.

Royal Bank also reported higher capital markets revenue, resulting from higher gross sales in its global markets and corporate and investment banking segments. The bank was also able to increase its stock dividends by 2% during the final quarter of the year.

Let’s look at some key metrics to determine if Royal Bank stocks are performing well. These market figures, however, tend to vary each day. Here are some key indicators of a good bank stock.

Market capitalization

This is the total value of the bank’s shares of stock. It gives investors a clearer picture of the company’s size compared to its competitors. Market cap is calculated by multiplying the total number of outstanding shares by their share price.

Price-to-earnings (P/E) ratio

This indicates whether a stock’s price is high or low based on the bank’s earnings. To calculate this figure, the bank’s current share price is divided by its earnings per share.

Price-to-book (P/B) value ratio

This is the ratio of the current market cap of a bank to its accounting value. To get this figure, the bank’s stock price per share is divided by its book value per share.

Investors searching for a stock with good growth potential often choose those with a low P/B ratio. This means they pay less for stocks with more book value.

Dividend payout ratio (DPR)

This tells how much a bank pays out to investors in dividends, in comparison to the earnings of the stock. The ratio is calculated by dividing the annual dividend per share by the earnings per share. The DPR can show how well a bank’s earnings allow for dividends.

Dividend yield

This indicates how much a company pays in dividends yearly, relative to its stock price. To calculate the dividend yield, the annual dividend per share is divided by the price per share.

Here are the RBC stock values for these metrics. These are based on data from the charting platform and investor social network Trading View and the financial research platform YCharts. The figures are accurate as of February 2, 2024.

- Royal Bank stocks market cap: $184.02 billion

- Royal Bank stocks price-to-earnings ratio: 12.53

- Royal Bank stocks price-to-book value ratio: 1.67

- Royal Bank stocks dividend payout ratio: 52.57%

- Royal Bank stocks dividend yield: 4.21%

Royal Bank’s stock price hovers around $133 since the start of the year. On February 2, the price opened at $131.46, the highest that day, and closed at $131.22. This was a 0.21% drop from the previous day. The latest stock price is also a 20.3% rise from its 2023 low of $109.11 registered on October 25.

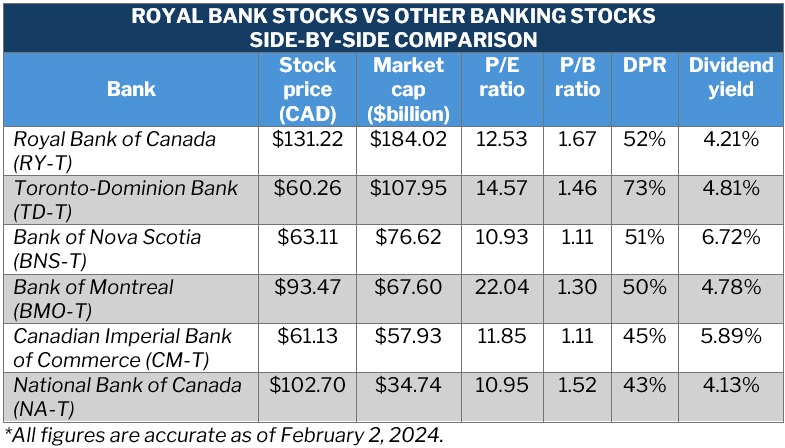

How do Royal Bank stocks compare with other banking stocks?

To give you an overview of how RBC stocks compare with those of other major Canadian banks, WP has compiled figures from Trading View, YCharts, and Simply Wall St. Here’s a side-by-side comparison of the stocks from the Big Six banks based on the latest pricing and key indicators mentioned above.

Is Royal Bank stock a good buy?

Royal Bank stocks are hovering firmly in positive territory, surging more than 20% since hitting lows during the October 2023 rout. RBC stocks are clearly on a roll, but this isn’t the only reason why they’re worth investing in. Here are the top reasons why Royal Bank stocks are a good buy.

1. Industry leader

The first obvious reason is that Royal Bank stands out above the rest of its competitors. As Canada’s largest financial institution, it offers an extensive range of products and services apart from banking solutions. These include capital markets, insurance, investment, and wealth management.

RBC is also growing faster than its Big Six cohort, beating earnings estimates set by analysts in the past several quarters. In addition, the banking giant’s balance sheet remains strong and capable of taking in further loan losses.

RBC has a rich history spanning 160 years. It also boasts a global reach, with operations in more than two dozen countries outside Canada and the US. Given its prestigious history and established reputation as a sound financial institution, Royal Bank can be deemed as a good investment.

2. HSBC mega-deal

Another obvious reason is Royal Bank’s acquisition of HSBC’s Canadian unit. All HSBC offices in the country are set to open as RBC branches on April 1, 2024. This means Royal Bank will be adding over 780,000 HSBC clients across the nation to its already enormous portfolio.

The merger, which is one of the largest in Canada’s banking history, can also push RBC share price even higher and enable the financial giant to pay even juicier dividends down the road.

While the deal didn’t come cheap – costing $13.5 billion – it makes Royal Bank even much stronger than its industry rivals.

3. Strong earnings

Royal Bank’s adjusted net income for the 2023 fiscal year reached $16.1 billion, slightly better than its 2022 results. This is despite the economic downturn and challenging conditions in the capital markets. Adjusted return on equity (ROE), meanwhile, dipped from 16.6% to 15.4%. RBC, however, remains profitable.

The banking heavyweight also finished the fiscal year with a common equity tier one (CET1) ratio of 14.5%, exceeding the 11.5% requirement set by regulators. This also translates into billions of dollars in excess cash, giving Royal Bank plenty of extra funding to ride out market volatility. A good portion of this cushion, however, has been set aside for the HSBC mega-deal.

4. Dividend yield

Royal Bank increasing the dividend twice in 2023 should be a signal to investors that its board is expecting a positive profit outlook for the 2024 fiscal year. With the current share price hovering at $133, investors can expect around 4.1% dividend yield from Royal Bank stocks. This also equates to a price-to-earnings ratio of just over 12 and a price-to-book ratio of about 1.7. These ratios indicate stronger value compared to the bank’s peers.

5. Workforce expansion, worthy causes

Royal Bank has revealed plans to establish a Global Banking Hub in Vancouver, positioning the city as an important hub for financial services. According to the banking giant, the move is expected to create more than 1,000 jobs in diverse sectors. These include technology, where professionals skilled in data science, cybersecurity, fraud detection, risk management, and client credit adjudication are predicted to be in high demand.

RBC also plans to increase its client operations and advice centre teams in Winnipeg, creating 100 new jobs.

In addition, Royal Bank has solidified its commitment to finance the renovation and construction of affordable and sustainable housing across Canada. It will continue to donate 1% of its profit before tax each year to this cause. The bank has also committed to contributing to the agro-processing sector to bring innovation and help boost food security in the country.

Apart from stocks, Royal Bank has a healthy portfolio of mutual funds. Learn more about this in our guide to investing in Royal Bank mutual funds.

How to buy Royal Bank stocks

Buying RBC stocks is a straightforward process that can take as little as 15 minutes. All you need is some industry knowledge, sufficient funds, and a brokerage account. Here’s a step-by-step walkthrough of how you can buy Royal Bank stocks:

Step 1: choose a brokerage platform

Royal Bank has its own brokerage platform, RBC Direct Investing, where you can access a range of investment opportunities. The platform, however, doesn’t always suit all types of investors.

If you’re looking for an option with lower transaction fees or more advanced trading features, it may be better to look at standalone brokerages. The key is searching for a reputable company that will allow you to deposit funds from an RBC bank account.

Step 2: open a brokerage account

Once you have chosen a brokerage platform that matches your needs, you’ll need to register and create an account. The process varies depending on the platform but generally it’s quite straightforward. You’ll be asked to provide personal information, including your:

- name

- address

- phone number

- Social Insurance Number (SIN)

- basic employment and financial information

Step 3: transfer funds to your account

Once the account has been approved, you can now transfer funds from your RBC account with just a few clicks. Most platforms offer different funding options, including electronic and wire transfers. Some also allow check deposits.

Step 4: research, analyze, and select stocks

Since you’re investing in Royal Bank stocks, all you need to do is search the platform for the RY stock code.

When purchasing any stocks, it’s important to conduct thorough research and select only the stocks you want to invest in. Most brokerage platforms also provide research and data analytics tools to help you make an informed decision.

It also helps to pay attention to external factors such as the company’s performance and growth potential, and industry trends. You can likewise make a list of stocks you’re interested in, so you can track their performance.

Step 5: purchase Royal Bank stocks

Choose the type of order you’d want to buy RBC stocks for. You can purchase RBC stocks using two methods:

Market order

Using this method, you can buy Royal Bank stocks at the current market price. This also means that you don’t have control over what price you transact at.

Limit order

This method allows you to set a specific price that you’re willing to purchase RBC stocks for. The transaction, however, won’t push through if you can’t buy the stocks for the price you set or better pricing. A limit order can be valid for up to three months, although some brokerages allow it to sit longer.

Step 6: monitor your investments

Once you’ve purchased the stocks, monitor their performance regularly. Brokerage platforms provide tools that enable you to track the performance of your investments, so you can adjust as needed.

Here’s a checklist of the steps on how to buy Royal Bank stocks:

If you want to find out how Royal Bank stocks compare to those of its peers, you can check out this guide on the best Canadian bank stocks to invest in.

Do you think Royal Bank stocks are the best investment among the Big Six? Will you consider other bank stocks apart from these? Let us know in the comments section.