Completing the IFC course is an important step towards getting a mutual fund licence. Find out what it covers and how it can benefit your career in this guide

In a highly specialized and tightly regulated mutual funds market, getting the right training is crucial if you want to build a successful career as a dealer or an investment advisor. But to obtain the necessary licence, you must first complete the required pre-licensing coursework.

The Investment Funds in Canada (IFC) course is one of your main options.

In this article, Wealth Professional delves deeper into this essential study program. We will give you a detailed overview of the coursework, including the curriculum, exam structure, and the different tools you can access. We will also discuss the skills you can expect to learn and credentials you can earn.

If a career as a financial planner or mutual funds dealer is something you’re considering pursuing, then this guide can prove useful. Read on and get the information that you need to start your investment career.

What is the IFC course?

The IFC course is one of the several programs offered by the Canadian Securities Institute (CSI). It is designed to provide advisors with the skills and knowledge necessary to handle mutual fund investments. It is also one of the two pre-licensing coursework options for those wanting to obtain a mutual fund licence.

Upon completion, you become eligible for a mutual fund dealer or dealing representative licence. This qualifies you to sell and provide advice on mutual fund investments.

The IFC course can be taken online and requires between 90 and 140 hours of study. You must complete the course within a year after enrollment, after which access to all materials and resources expires.

Who should take the IFC course?

The IFC course is designed for aspiring mutual fund representatives whose role entails helping clients build a portfolio aligned with their financial goals. The program, however, can also be taken by financial industry professionals who want to deepen their understanding of the capital markets.

You can take the Investment Funds in Canada course if you plan on becoming a:

- compliance professional

- discount broker

- financial planner

- investment representative

- insurance sales professional authorized to sell mutual funds

- personal banking representative

If you’re looking for other courses to advance your career in the industry, you can check out our guide to Certified Financial Planning courses in Canada.

What does the IFC course cover?

The Investment Funds in Canada curriculum contains 18 chapters covering a range of topics designed to prepare you for the role of a mutual fund representative. These include:

- a detailed overview of the financial markets and mutual fund industry

- your legal, ethical, and professional responsibilities as a mutual fund dealer

- the different types of mutual funds

- assessing risk-return relationships in investments

- building and managing investment portfolios aligned with clients’ financial goals

- evaluating mutual funds’ performance and fee structure

- how to apply the “know-your-client” rule

- client focused reforms

- how exchanges and clearinghouses work

The table below summarizes the chapters in the IFC syllabus, along with a brief description of each.

Investment Funds in Canada (IFC) course curriculum

|

Chapter |

Description |

|

1 – The role of the mutual fund sales representative |

Explains the legal, ethical, and professional responsibilities of a mutual funds dealer, why licensing is important, and how to provide excellent customer service |

|

2 – Overview of the Canadian financial marketplace |

Discusses how the financial market works, including the securities regulatory framework and the roles that the different types of intermediaries play |

|

3 – Overview of economics |

Covers key concepts in economics, including economic growth, labour market indicators, interest rates, and inflation; explains how monetary and fiscal policies affect the economy |

|

4 – Getting to know the client |

Provides tips and strategies on client communication and financial planning |

|

5 – Behavioural finance |

Discusses investor behaviour and how dealers can apply bias diagnoses when structuring asset allocation |

|

6 – Tax and retirement planning |

Explains how the taxation system and major pension plans in Canada work |

|

7 – Types of investment products and how they are traded |

Gives a detail overview of the different types of securities, including features and pricing |

|

8 – Constructing investment portfolios |

Discusses key concepts on portfolio creation and management, including how to measure risks, calculate returns, and analyze portfolios |

|

9 – Understanding financial statements |

Explains the different types of financial statements and how to analyze them |

|

10 – The modern mutual fund |

Discusses everything you need to know about mutual funds |

|

11 – Conservative mutual fund products |

Covers money market mutual funds, mortgage mutual funds, and bonds and other fixed-income funds |

|

12 – Riskier mutual fund products |

Covers equity mutual funds, balanced mutual funds, global mutual funds, and specialty mutual funds |

|

13 – Alternative managed products |

Covers exchange-traded funds, hedge funds, principal-protected notes, close-end funds, and segregated funds |

|

14 – Understanding mutual fund performance |

Explains how portfolio performance is evaluated, including how comparison universe and quartile rankings are used |

|

15 – Selecting a mutual fund |

Provides a step-by-step guide on how to choose a mutual fund, including the different elements to consider |

|

16 – Mutual fund fees and services |

Covers fees, charges, and taxes; explains what accumulation plans and systemic withdrawal plans are |

|

17 – Mutual fund dealer regulation |

Explains securities regulations, including registration requirements, selling practices, and know-your-client rules; provides a step-by-step guide on how to open a mutual fund account |

|

18 – Applying ethical standard to what you have learned |

Discusses ethics and the Standard of Conduct; provides case studies on how you can apply everything that you’ve learned |

Once you’ve completed the IFC course, you will receive a Notice of Course Completion through your student profile. You can also receive a digital badge like these:

You can post your credentials across the web, including on your email signature, personal website, and social media accounts. You can also put it on electronic copies of your resume.

The CSI provides a wall certificate within four to six weeks after you’ve completed the course. The institute also gives all students who get a final course mark of 85% or higher an honours certificate.

If you’re new to investing in mutual funds, here’s a comprehensive guide to help you understand how the process works and give you tips on how to reap huge returns.

IFC examination and credits

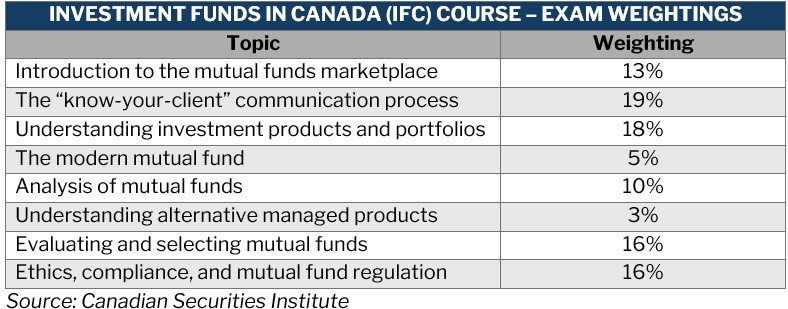

The IFC exam runs for three hours and consists of 100 multiple choice questions. Here’s how the topics covered in the IFC course are distributed in the test.

To pass, you must get at least 60% of your answers right. If you fail on your initial attempt, you get two more attempts to get a passing grade. If you fail in all three attempts, then you must re-enrol in the program. You can only do so, however, six months after your last attempt.

Only the first exam is included in the enrollment fees. You will need to pay for your subsequent attempts separately.

You can take the IFC examinations online or write them in-person at any of the 17 testing centres across the country. The tests are typically scheduled from Mondays to Saturdays during office hours, although the dates and times may vary depending on the location. You can check out the list of IFC testing centres, along with the addresses and exam schedules, on the CSI’s website.

IFC exam results

After completing the exam, you will be given a pass or fail mark. You can receive the official results within 24 hours for multiple-choice exams. If you have taken an exam in another format – constructed-response format, for example – the results will be available after 30 business days.

The CSI also provides a student performance record (SPR), which shows how well you scored in the different topics.

IFC course credentials

Completing the IFC course counts toward the following credentials:

- Personal Financial Planner (PFP)

- Estate & Trust Professional (MTI)

- Certificate in Financial Services Advice

- Certificate in Advanced Mutual Fund Advice

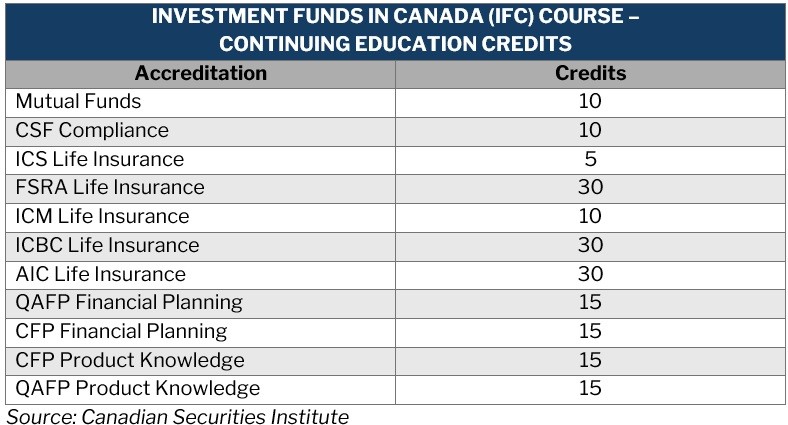

IFC course continuing education credits

Completion of the IFC course also enables you to earn continuing education (CE) credits, which vary depending on your accreditation:

How much does the IFC course cost?

You can take the IFC course online by registering on the CSI website’s IFC Enrol page. The classes are interactive. The online course with a PDF textbook costs $470. If you prefer to have a hard copy of the textbook, you will need to pay $520.

You can also purchase the IFC course value pack combo for $715. The package allows you to access a full set of study tools, including:

- IFC Check: a set of timed and structured online practice tests designed to assess your readiness to take the actual IFC exam; costs $150 if purchased separately

- Financial Investment Calculations toolkit: a set of tools and resources to help you with financial services-related calculations; costs $95 if purchased separately

- Financial Statement and Ratios e-Tutorial: a refresher course that introduces you to important concepts commonly used in the financial services industry; costs $55 if purchased separately

- Macro and Microeconomic e-Tutorial: a refresher course that provides an overview of the two areas of economics; costs $55 if purchased separately

You can find the complete list of tools and resources on the CSI website’s IFC Study Tool page.

Enrollment is valid for one year, which means you have to complete the course within that time frame. Access to all materials and resources also expires two weeks after completing the IFC course.

If you prefer a more personal approach, you can enrol in in-person classes. CSI has partnerships with several community colleges to help students prepare for the IFC examinations through the CSI Global Education program. You can find out more about this program by contacting the institute’s toll-free number: 1-866-866-2601. You can also send an email to [email protected].

What is the difference between IFC and CIFC?

Before you can obtain a mutual funds licence, you need to complete a pre-licensing course. You generally have two options. Apart from the IFC course, you can choose to take the Canadian Investment Funds Course (CIFC) from the IFSE Institute. For the most part, these courses cover the same topics. The choice on which program to take depends on your personal preference and career goals. One major difference between the IFC and CIFC is that the former counts toward a PFP designation.

Here's a more detailed explanation about the similarities and differences between the two courses:

Both courses are designed mainly for those who want to sell mutual funds and provide investment advice. If you’re planning to sell other types of investment products, such as bonds or stocks, you will need to take the Canadian Securities Course (CSC), also offered by the CSI.

You can find out everything you need to know about the Canadian Securities Course in this guide.

What does a mutual fund sales representative do?

A mutual fund sales representative (MFSR), more popularly known as a mutual funds dealer, is an industry professional licensed to sell and give advice on mutual fund investment products. If you become one, you can find employment through the financial services industry, particularly in mutual fund dealerships and financial planning firms. Insurance agents and personal banking representatives may also get a licence to sell mutual funds.

Apart from sales, a mutual fund representative is tasked with helping clients create and manage a portfolio that suits their financial needs. They’re also responsible for opening accounts for new clients and providing them with the account information and performance reports.

Those planning on branching out to other types of investments, such as stocks and bonds, will need to become a licenced investment advisor. This role comes with a different set of requirements and credentials.

If you’re wondering how you can succeed as a mutual fund advisor, then our Best in Wealth Special Reports page is the place to go. The professionals featured in our special reports have been nominated by their peers and vetted by our panel of experts as trusted and dependable market leaders.

Recently, we unveiled our five-star awardees for the 50 Best Fund Wholesalers in Canada. Find out how these individuals rose through the ranks to become among the most respected names in the industry by checking out our special report.

Have you experienced taking the IFC course? How was it? Share your story in the comments.