Learning how to invest in stocks involves understanding the intricacies of the stock market. Find out how you can navigate stock investing in this guide

At first glance, investing in stocks seems like a straightforward process. You buy shares in a company, hope the business grows and performs well over time, and get a return on your investment. But in reality, stock investing involves a more complicated process, which new investors can find intimidating.

If you’re just starting out on your investment journey and considering going into stocks, this guide can help ease your fears. Here, Wealth Professional explains the basics of how to invest in stocks, including the step-by-step process and your investment options.

To the financial advisors who typically visit our website, this article is part of our client education series and can be a good resource to share with your clients.

How does stock investing work in Canada?

When you buy a stock – also referred to as an equity – you gain partial ownership in a company. Public companies issue stocks as a way to fund their operations. If you’re an investor and you think that a business will grow in the future, you can buy stocks from this company.

If your hunch is right, you can receive dividends plus appreciation in the price of the shares. But if you’re wrong, you can see your investment dwindle or disappear completely if the business goes bankrupt.

Another way to make money while investing in stocks is by buying a share at a lower price and selling it for higher. This price difference is what is called in the industry as capital gain. On the flipside, selling stocks for less results in a capital loss.

How much do you need to start investing in stocks? Not that much. Most brokerages in Canada don’t require a minimum amount. This means that you can start purchasing stocks for as little as $1.

One of the best ways for you to learn how to invest in stocks is by placing your money in an online investment account and buying stocks from there. Some brokers also allow paper trading, which teaches you how to invest in stocks using simulators before you can invest actual money.

Here’s a list of the best Canadian bank stocks to invest in right now, complete with numbers and analysis.

What should you consider before investing in stocks?

Just like with any type of investment, you will need a certain level of understanding of how stocks work before investing. Given the volatility of the stock market, the stakes are higher but so are the potential returns. These are the factors that you need to consider before investing in stocks:

1. Your investment goals

A big part of learning how to invest in stocks is asking yourself, “What are my overarching goals?” Do you want to invest long-term, or do you want your portfolio to earn income? Knowing your investment goals can help narrow down your investment options and simplify the process. This will also help you determine how much risk you’re willing to take and which investment accounts to prioritize.

2. The investment accounts

Once you’ve determined your investment goals, you need to pick which investment accounts – also called investment vehicle – to use. Bear in mind that you’re not limited to a single account. Certain investment accounts work well together to accomplish an investment goal.

Generally, you have three options when it comes to investment vehicles:

Brokerage account

A brokerage account may suit you if you prefer a more hands-on approach to building your portfolio. Brokerage accounts allow you to buy and sell stocks without imposing any cap on how much you can invest. Most also don’t have rules on fund withdrawals.

Robo-advisor

A robo-advisor is an automated investor service made possible by artificial intelligence. It uses complex algorithms to identify your financial goals and risk profile, then bases its decisions on these factors. This type of investment vehicle works best if you have clear and straightforward investment goals.

Financial advisor

Enlisting the services of an experienced financial advisor is the way to go if you want a hands-off approach to stock investing. These industry professionals will do the heavy lifting and make investment decisions on your behalf.

3. How much you want to invest

Part of learning how to invest in stocks is determining how much of your income you want to allocate for your investments. The amount will depend on your investment goals and the timeframe for achieving these goals, also referred to in the industry as time horizon. There may be limits on how much you can invest depending on your investment account.

4. Your risk tolerance

Risk tolerance refers to the level of risk you’re willing to take as an investor for the potential of a higher return. Your risk tolerance plays a huge part in how you choose stocks to add to your portfolio.

Are you considering buying Royal Bank stocks? Check out this guide for prices and analysis.

How to invest in stocks: a step-by-step guide

When investing in stocks, there are certain steps you need to follow, especially if you’re a new investor still trying to establish your financial footing. Here’s a step-by-step guide on how to invest in stocks for beginners:

Step 1: Open a brokerage account.

Everyone who wants to invest in stocks needs to open a brokerage account. If you prefer a hands-on approach – also known as a self-directed investor – you can open an online account and do the stock trading yourself. You will incur fees for maintaining the account and making trades, but online brokerages are often the cheapest option.

You can also buy and sell stocks with the help of an industry expert, such as a financial advisor or stockbroker, but you will have to pay higher fees.

Step 2: Choose an investment account.

As a starting investor, you can choose to invest in a registered or non-registered account. Here are your options:

Registered investment accounts

Registered accounts are offered by the Canadian government. These accounts give you access to tax benefits, but contribution limits and rules on withdrawal apply.

Tax-free savings account (TFSA)

A TFSA lets you invest and save money for your future, including retirement. A TFSA is an attractive option for stock investors since the account isn’t taxed. However, annual contribution limits apply. For 2024, the cap set by the government is $7,000.

Registered retirement savings plan (RRSP)

An RRSP allows you to defer paying taxes on your earnings, including investment returns, unless you withdraw the funds early. RRSPs are designed to help you save for retirement. You can contribute up to 18% of your income from the previous year as long as it doesn’t exceed the annual limit of $31,560 in 2024.

Registered education savings plan (RESP)

An RESP allows you to save for your child’s post-secondary education. If you choose to invest in an RESP, you can receive up to $7,200 in open scholarship fund for each child under the plan.

Non-registered investment accounts

Non-registered accounts don’t offer tax benefits, but they also don’t have annual contribution limits and withdrawal penalties.

- A cash account allows you to buy and sell stocks with the funds in the account, just like a debit card.

- A margin account lets you borrow money from a brokerage to buy investments, such as stocks. The money you borrowed must be paid with interest, much like a credit card. This type of account is more suited for experienced investors than for those who are just starting out.

Step 3: Fund your account.

Most brokerages in Canada don’t impose account minimums, but you can’t invest in stocks without funds. There’s no one-size-fits-all amount for all types of investors. It’s best to start with an amount you’re comfortable with.

Step 4: Research potential stocks.

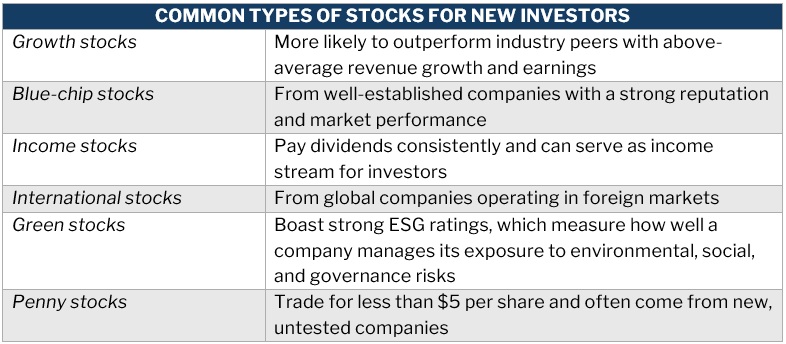

There are several types of stocks you can invest in. These are the most popular ones for new investors.

You can compare stocks in two ways:

- Fundamental analysis: evaluates a stock based on a company’s financial history and economic data

- Technical analysis: uses charting tools accessed through trading platforms and provides complex insights into a stock’s performance over time; more suited for experienced investors

If you want to gain valuable investing experience without risking a dime, you can open a practice account, also called a paper trading account, offered by some brokerages. This simulates the stock market in real-time, so you can learn how to invest in stocks without putting money on the line.

Step 5: Buy your stocks.

Once you feel confident enough of your stock trading skills and have done your research, it’s time to pick a stock. You can buy stock from any of Canada’s exchanges listed below:

- The Canadian Securities Exchange (CSE)

- Montréal Exchange

- Nasdaq Canada

- Toronto Stock Exchange (TSX)

- TSX Venture Exchange (TSXV)

You can check out the complete list of designated stock exchanges in the country on the Department of Finance’s website.

When choosing a stock, you need to search for the company or the ticker symbol. The ticker symbol is a set of letters used to identify stocks on the exchange. You will also need to indicate how many shares you want to buy. You must purchase at least one stock. For the order type, you can choose “market order” to purchase stock at the current market price. Once done, you can submit your order to complete the trade.

You can only make trades during stock market hours. The exchanges listed above are open Monday through Friday from 9:30am to 4pm EST and closed for Canadian holidays. If you’re unable to trade during these hours, you can set up trades outside regular market hours. These will be executed once the stock market opens.

Step 6: Track your investments.

Stock investments require careful monitoring, that’s why it’s important that you schedule regular portfolio check-ins. How often you track your investments depends on your investment strategy. For new investors who plan to hold their stocks for the long term, reviewing their portfolios once a month may be enough. Once you gain more experience and begin to trade stocks more frequently, that’s the time you may want to check your investments daily.

Are TD Bank stocks a good investment? Find out in this guide.

Making sense of stock market jargon

Learning how to invest in stocks involves understanding the key terms that will enable you to make sound investment decisions. Here are some common stock market buzzwords you need to know:

- Ask: the lowest price sellers are willing to accept for a stock

- Bid: the highest price buyers are willing to pay for a stock

- Change: the difference between the current price and the previous day’s last price

- Dividend yield: how much a company pays out each year in dividends to shareholders in relation to its stock price

- Earnings per share (EPS): a measure of how much money a company makes for every share of stock that it issues

- Last price: the last transacted price of a stock for the day

- Limit order: an order to buy or sell a stock at a specified price or better

- Market order: an order to buy or sell a stock at the best available price

- Price-to-earnings ratio (P/E ratio): measures a company’s current share price in relation to its per-share earnings

- Range: the highest and the lowest trading prices for a certain period

- Share: a unit of stock or ownership in a company

- Volume: the total shares traded throughout the day

- 52-week range: the highest and the lowest price a stock traded in the past year (52 weeks)

Can you invest in stocks without a broker?

Even as a new investor, you’re not required to hire a stockbroker to buy and sell stocks. In most cases, however, you will need to work with a brokerage firm. Brokerages can offer you strategic investment advice and make trades on your behalf. Some provide access to a platform where you can execute trades yourself using an automated robo-advisor. The choice depends on your investment style.

If you’re seeking guidance as you start your investment journey, these five-star winners of The Best Wealth Management Firms in Canada can help. By partnering with these companies, you can be sure that you're making sound investment decisions and building a solid portfolio.

Did you find this guide on how to invest in stocks helpful? Let us know in the comments.