The Chartered Accountant title was merged into the CPA designation, so is it still possible to become a CA? Read this for more information and clarification.

To say that finance professionals have it good is not an exaggeration. Even without any other degrees apart from a bachelor’s or any other designation, finance professionals can look forward to a long and prosperous career.

But as it is, the finance industry is very competitive. Those who want to advance to higher positions, establish their own firm, or even ask for a raise may later realize the need for either higher educational degrees or additional finance credentials.

One of the credentials that can help financial advisors is the chartered accountant or CA.

But before we begin, let’s be clear: the designation of CA or chartered accountant in Canada was merged into one designation, that of chartered professional accountant or CPA. Note also that the term CPA in Canada is not to be confused with the CPA designation in the US, which stands for certified public accountant. It’s also different from the CPA designation in Australia, which means certified practising accountant.

It may sound contradictory to discuss a designation that no longer exists but hear us out. This article is not only for the benefit of finance professionals in Canada, but also for those who are not aware of changes like these in the Canadian financial industry.

So, in this article, Wealth Professional discusses how financial advisors can become chartered professional accountants. We’ll offer an overview of the chartered accountant role and how this evolved into the CPA designation. We’ll tackle the pertinent questions you may have about this title, such as how to become a CPA in Canada, what courses are required, what requisite education should candidates have, and more.

What is a chartered accountant (CA)?

Before its folding into the chartered professional accountant role, chartered accountants in Canada were accounting professionals who had the qualifications to take on specific activities that were within the spectrum of accounting tasks. These tasks often included, among others:

- auditing financial statements

- filing corporate tax returns

- providing financial advice

The tasks of a chartered accountant

CAs were counted as highly educated and competent accounting professionals who had many job functions. These roles depended on the specific area of accounting they practiced. The four main areas that CAs worked at included:

Applied finance

This is the practical application of financial knowledge and methods. Chartered accountants in this subcategory worked to create profitable financial models and recommendations for businesses and other organizations.

Financial accounting and reporting

Also known as FAR, this area of accounting monitored education and general funds, designated funds, auxiliary funds, restricted funds, and agency funds. Those who work in FAR are responsible for maintaining a high level of understanding of the rules and regulations and providing technical assistance to businesses and organizations.

Management accounting

Sometimes referred to as managerial accounting, chartered accountants serve as consultants. They use the financial data of a company or organization to help them make informed decisions. In this capacity, they are also tasked to help manage and perform their control functions.

Tax accounting

This involves preparing tax returns and tax payments by individuals, and entities like businesses and corporations. This accounting subcategory is chiefly concerned with computing income or revenue, qualifying deductions, donations, and gains or losses on investments to determine the taxes owed.

The difference between CA and CPA in Canada

To further explain the difference between the CPA and the CA in Canada, here are their separate definitions.

Chartered accountant (CA)

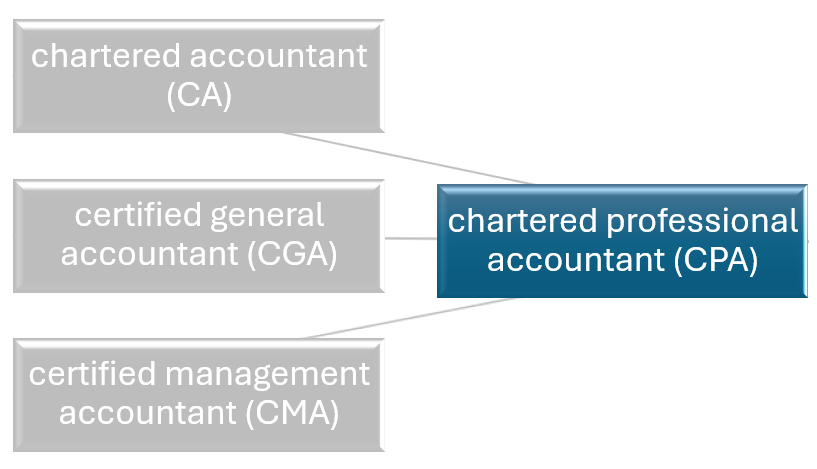

The CA was a designation that Canadians could earn after taking the appropriate courses and exams, apart from having the requisite bachelor’s degree. The chartered accountant (CA) designation, along with the certified general accountant (CGA) and the certified management accountant (CMA) were unified under the chartered professional accountant (CPA) title in 2014.

The CA title refers to accountants who practice in countries like India, Ireland, Singapore and the UK. CAs continue to be recognized by these jurisdictions for their technical expertise in accounting.

Chartered professional accountant (CPA)

The CPA in Canada is a merging of the CA, CGA, and CMA designations. The chartered professional accountant designation is granted at the provincial level. If a finance professional works to obtain their CPA title in Ontario, then CPA Ontario grants the designation in accordance with the CPA Ontario Act.

Each province has its own CPA chapter that grants the CPA designation.

CPAs find employment in a wide range of industries, including:

- public accounting

- government agencies

- educational institutions

- non-profit organizations

CPAs typically conduct thorough financial analysis, are excellent in practicing sound judgment, can communicate effectively, and can be expected to act in the public interest.

Employers and recruiters view CPAs as valued talent, due to their experience and success in accounting.

A CPA career can be very rewarding for someone with excellent analytical, research, and communication skills.

How to become a CPA

As the CA designation now falls under the CPA, those who originally intended to acquire the CA title must pursue the CPA instead. One of the requirements for becoming a CPA in Canada is for candidates to have at least 30 months of practical accounting experience.

They must also have an undergraduate or bachelor’s degree. You can use this guide to find the right courses and accredited universities to get the required training. If a candidate does not have an accounting degree, they may take CPA Prep courses instead.

Those who do not have the requisite education may take the CPA test after having eight years of relevant work experience and completing the required courses.

Depending on their educational background, work experience, age and other factors, candidates may find that their journey to becoming a CPA can vary in terms of time and requirements. These are the common steps aspiring CPAs will take toward certification:

Step 1. Get a bachelor’s degree

The first requirement is to have an undergraduate degree. While CPA Canada does not require that the degree be strictly in accounting, it would be more beneficial to earn a degree in related fields.

A degree in accounting, business, finance, or other closely related field should equip candidates with the fundamentals of finance and accounting concepts.

If your chosen degree does not have the coursework that qualifies as relevant material for the CPA title, you can take CPA Canada’s Prep course. This can take around two years to accomplish.

CPA Canada may ask for a transcript to look at your grades, so remember the importance of how well you do in your course. Better grades can increase your chances of getting accepted into the program.

Step 2. Take the CPA Professional Educational Program (CPA-PEP)

After completing your bachelor’s degree, you may apply for the CPA-PEP. The prerequisites in each province or territory can vary, so check your local CPA branch to ensure you meet them before applying.

You’ll need to share your personal information, educational background, and proof that you have good character, such as a reference letter.

Step 3. Complete the modules of the CPA-PEP

There are six modules in the CPA Professional Education Program which should be completed over a two-year period. Advancing to the next module means having to pass an examination. The modules include:

- Two common modules covering six technical competencies, including audit and assurance, finance, financial reporting, management accounting, taxation, and strategy and governance

- Two elective modules where you can choose one of the following: assurance, finance, performance management, or taxation

- One capstone integrative module focusing on building leadership and professional skills

- One capstone exam preparation module to get students ready for the final exam

Step 4. Accumulate 30 months’ worth of accounting experience

Apart from the coursework that must be completed within the CPA-PEP, candidates must accumulate 30 months (2½ years) of experience in an accounting role. There are two options for meeting the experience requirements:

- Take the pre-approved program route: CPA Canada partners with employers in your area that can offer employment and training programs to students. This assigns you a mentor who can help guide you.

- Taking the experience verification route: Candidates can choose to find work at a different employer, but CPA Canada must approve your choice. In this option, it's the candidate’s responsibility to find a CPA mentor willing to guide and coach them.

Step 5. Pass the CFE – Common Final Examination

Passing the CFE is mandatory for all CPA candidates to obtain their CPA title. The CFE takes three days to complete and tests students' competencies in these areas:

- advanced financial reporting

- audit and assurance

- decision making

- ethical behaviour

- finance

- leadership

- management accounting

- problem solving

- professionalism

- strategy and governance

- taxation

- written and oral communication

Understanding the Common Final Examination (CFE)

The CFE is computer-based, with different components like written communication, multiple-choice questions, and case study questions. Candidates can choose to take the four areas of the examination at once or one after another.

Should candidates decide to take the four-hour sections consecutively, they are given an 18-month period to complete the tests. The CPA exam is a continuous test, which means candidates can retake the test at any time. Passing the examinations requires that candidates must score at least 75% or higher in each of the four sections.

Here’s a video discussing the CPA-PEP and CFE in more detail. The presenter explains the points of entry in the CPA-PEP, the course components, course requirements, and other related topics, so be sure to watch the video till the end.

Step 6. Obtain and maintain your CPA designation

After passing the Common Final Examination and having 30 months of work experience, CPA candidates can earn the CPA designation. To maintain it, CPAs need to complete continuing education (CE) courses each year.

Your province or territory may have specific requirements to maintain the certification; this usually consists of 30 hours of continuing education. CPAs are also required to pay yearly membership fees.

Applying for CPA positions

Finally, after you’ve obtained the CPA title! You can start applying for CPA jobs if you don’t have one already.

Look for relevant postings on job boards or on company websites. To apply for these positions, make sure to have an updated resume ready. Highlight your new credential by including it at the top of your résumé next to your name.

This is one of the first things prospective employers look for to ensure you're qualified, so placing your designation at the top encourages them to keep looking at your résumé.

A good strategy to use when applying is to include keywords you find in job postings or descriptions, such as specific skills. This can attract employers or recruiters who are looking for those who have the skills and experience they're looking for; this also helps you stand out from other jobseekers.

For younger workers, base salary is only one factor they consider when making a move. https://t.co/hn5JqbSrSo pic.twitter.com/ZWw3Zujwqy

— CPA Canada (@CPAcanada) January 3, 2024

Canadian CPA salaries

Since the CA was folded into the CPA title along with the CMA and CGA designations, those wondering about salaries of these other accountant designations should look to CPA salaries from now on.

Salaries for CPAs in Canada are considered high, with average salaries topping $90,000 a year or $46.15 per hour.

CPAs starting in entry-level positions typically earn $68,384 per year. More experienced CPAs in Canada can make upwards of $115,000 per year.

CPAs who reach the rank of partner in an accounting firm or CEO of a company can easily earn more.

The average salaries can vary from province to province. These can vary even more depending on which industry they practice in.

In Ontario, for example, these are some of the average salaries for experienced CPAs in different industries:

|

Industry |

Salary per year |

|

Auditing services |

$123,000 |

|

Marketing/Advertising |

$113,000 |

|

Retail companies |

$126,000 |

|

IT and Financial Services |

$150,000 |

Is the CPA designation in Canada worth it?

For the financial professional who wishes to earn a hefty salary from a prestigious title in the finance industry, the CPA designation can be well worth the time and effort.

Not only does pursuing the CPA title confer greater knowledge in accounting and finance, but it also endows its holder with other benefits. Working towards the CPA title can help you get practical accounting experience and a network of contacts. This is a result of the 30-month relevant work experience requirement.

In terms of giving value to society, as a CPA, you can commit yourself to working for companies that only do good. You can dispel the myth that a finance-related job like yours is not a conscientious one.

What’s more, highly qualified finance professionals, especially CPAs, will always be in demand in the accounting, business, and financial industries. Obtaining the CPA designation in Canada also trains you to become a finance professional ready to meet the needs of local and international businesses.

As a CPA, you have more opportunities to grow and flourish in your career or even start your own business or accounting firm. With all these benefits, becoming a CPA can be worth it.

Are you considering becoming a CPA? Share your thoughts with us in the comments