Horizons ETFs portfolio manager Hans Albrecht on how borrowing capacity is taking hold in the world of robotics

by Hans Albrecht

VP, Portfolio manager and options strategist, Horizons ETFs

You might have heard that the sharing economy is upon us in a very big way.

But what is it exactly?

Quite simply, it’s taking action on the premise that excess capacity can be made available to others. In other words, when we own something, we usually can’t use it 24/7, and what capacity we aren’t using we can share, usually for a fee. Ride-sharing, apartment sharing, even swimming pool sharing! What’s next, renting the shirt off my back? Oh yeah, it’s already being done with apps like Tulerie. Rent out some of what you have (a room), or rent it all out (the whole house) – the decision is up to you.

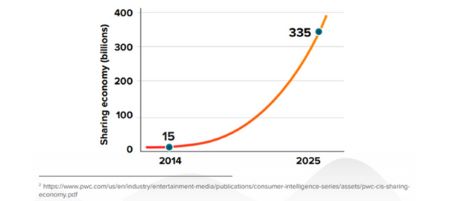

And it seems that it’s a decision that more people than ever are embracing, and more corporations are capitalizing on. The sharing/fractional economy is projected to grow from $15 billion in 2014 to $335 billion in 2025.

Is sharing new? No, my neighbour likes to borrow my lawnmower, which I share (begrudgingly, rent-free). But that kind of local community sharing concept has been blown wide open with the internet and the way it is connecting us all more intimately than ever. Distance between parties no longer matters as technology enables us to connect with and therefore transact with others far and wide.

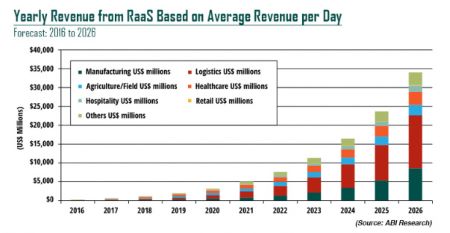

In the world of robotics the concept of borrowing capacity is also taking hold. In fact, due to the high up-front costs of robotic and automation solutions, the idea works very well. Robotics have long been used in the automotive industry, but high initial and maintenance costs have made the option unfeasible for most other businesses. Just as ride-sharing helps negate the need to buy a car, so too does RaaS – Robotics as a Service. Need a fleet of robotic warehouse sweepers? Rent it, for a fee - in this way robotics becomes a service rather than a product per se, and thus infinitely more accessible. When something in high demand gets cheaper and more accessible we can expect proliferation to surge. And indeed surging demand for automation across manufacturing, automotive, defence and logistics, agriculture, and healthcare sectors is pushing deployment of robotics like never before. But this surge isn’t like anything we have ever seen – it is connecting robots, sensors, and cloud-based intelligence and resources.

To me, cloud robotics is really the essence of Industry 4.0 – a coming together of copious amounts of data, artificial intelligence, advanced algorithms and physical hardware like never before, resulting in a reshaping of our world in ways that will only be limited by our imaginations. It’s happening right now, and it’s still the early innings. The application potential for these systems is vast. Robots are getting smaller, less expensive, safer and more customizable each year. Some of the leaders in the global cloud robotics market include ABB Group, Fanuc Corp and Yaskawa Electric Corp, just a few of the constituents in the Horizons Robotics & Automation Index ETF (“RBOT”).

The views/opinions expressed herein may not necessarily be the views of Horizons ETFs Management (Canada) Inc. All comments, opinions and views expressed are of a general nature and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.