According to the Fraser Institute the wealthiest income-earning families pay an oversized percentage of all Canadian taxes

Financial inequality is gaining ground globally as a hot topic, with the pandemic having shone a spotlight on the difference between the ‘haves’ and the ‘have nots.’

But are calls for the richest in our society to pay more tax – on the basis of fairness - borne out by the data?

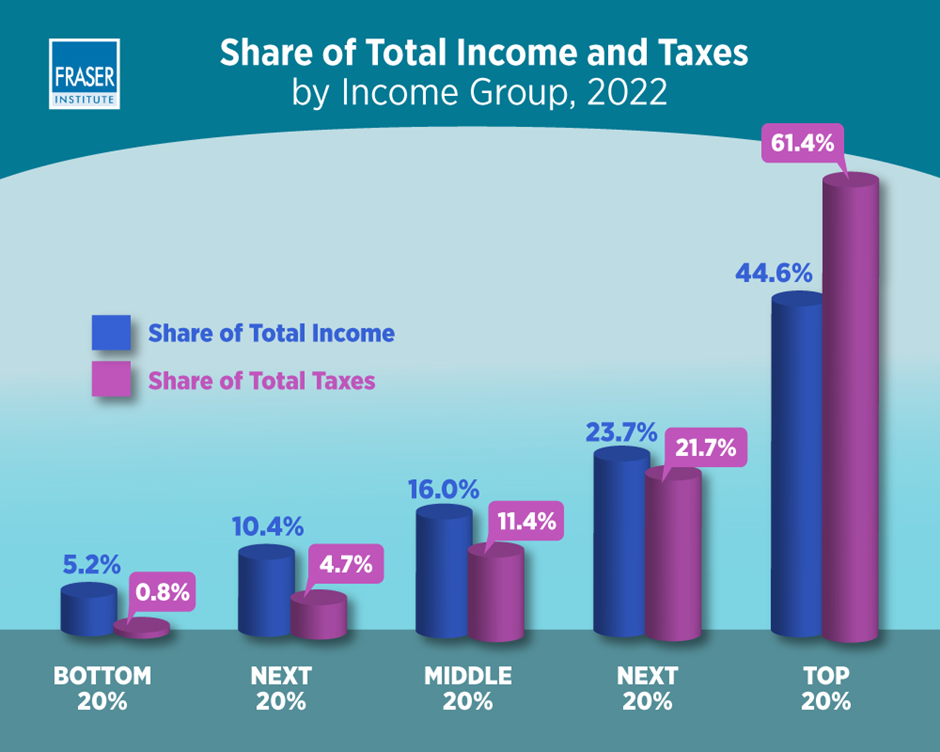

Not according to a study by the Fraser Institute which reveals that the top 20% of income-earning families in Canada pay more than half of total taxes including personal income, sales and property taxes.

“Despite the common misperception that top earners don’t pay their ‘fair share’ of taxes, in reality these households pay a disproportionately large share of the total tax bill,” said Jake Fuss, associate director of fiscal studies at the Fraser Institute and coauthor of Measuring Progressivity in Canada’s Tax System, 2022.

Fuss discovered that, while the top 20% earn more than 44% of total income, they pay 53% of tax. Those in the lowest 20% of income-earning families earn 5.2% of all Canadian family income and pay 0.8% of tax.

All 80% of income-earning families outside of the top 20% paid less in total taxes than they earned in total income.

“The assertion that the top 20% of earners in Canada are not paying their fair share is simply not supported by the evidence,” commented Fuss.

Wealth tax

The study is unlikely to calm calls for wealthy Canadians to face higher taxes as it does not negate their sizeable fortunes compared to those who have less, but it does highlight that – in percentage terms – wealthy Canadian families are paying more.

A recent study by the Montreal Economic Institute found that taxing the rich through selective measures are ineffective.