Deals fell sharply in the first quarter of 2023 with larger transactions most impacted

The number of venture capital (VC) deals in the first three months was down significantly from a year earlier, reflecting investors’ growing caution.

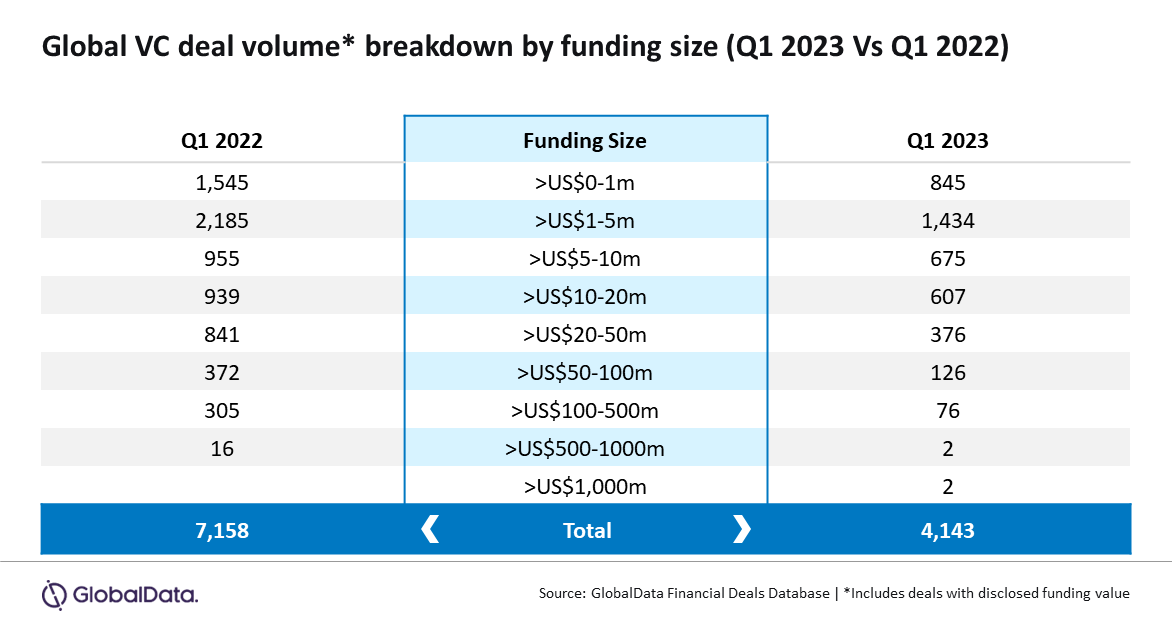

GlobalData’s newly-published report reveals a 42% slump in VC deals globally to 4,143 in Q1 2023 compared to 7,158 announced in the first quarter of 2022. The stats focus on VC funding deals with disclosed funding value.

The number of low-value deals - that’s those with investment equal to or less than U$10 million – was down 37% globally to 2,954 in Q1 2023 compared to 4,685 a year earlier.

Low value deals accounted for 71% of total VC deals globally in the first quarter of this year.

Larger deals collapse

But it was the larger deals – those valued at more than $100 million – that suffered the biggest decline, dropping 75% to just 80 deals compared to 321 in Q1 2022.

“High-value transactions were impacted as VC investors remained cautious for committing big investments over the prevailing geopolitical conditions, macroeconomic challenges and recession fears,” said Aurojyoti Bose, lead analyst at GlobalData.

The exception to the decline of larger deals was a rebound for those valued at more that $1 billion. There were two in Q1 2023 compared to none a year earlier.

“Although the number of big-ticket deals is not too high, their comeback during the quarter despite the challenging market conditions is a reason to cheer for promising startups,” Bose added. “It indicates that investors are still willing to place big bets in promising startups despite the overall decline in deal activity.”